U.S. Elections - Potential Market Impact And Investment Considerations

KEY POINTS

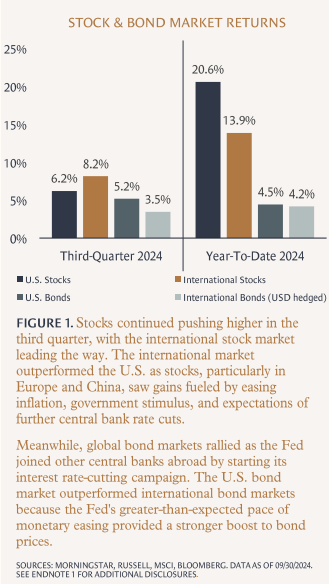

Global stocks advanced in the third quarter as investors rotated into a broader range of sectors, while bonds rallied on falling interest rates and easing inflation. Looking ahead, we discuss why stock market gains could continue, granted more modestly, and why bond market returns will likely stay strong.

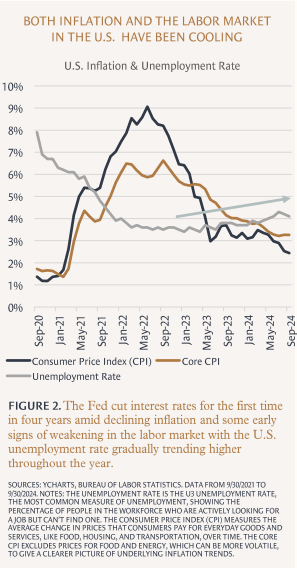

The U.S. economy remained resilient, supported by solid consumer spending, as the Federal Reserve cut rates amid cooling inflation and a slowing labor market. Our outlook discusses why the U.S. economy should maintain steady growth into 2025 and why international growth may face headwinds from regional challenges.

The outcome of the U.S. elections could influence policy changes in areas such as taxes, trade, and regulation We examine the potential market implications and what investors should keep in mind as election day approaches.

Finally, we discuss how to strategically position portfolios amid a broadening stock market rally, interest rate cuts, and risks of slowing growth, as well as highlight opportunities in real estate, infrastructure, and bonds.

VIEW A SHORT SUMMARY VIDEO

MARKET REVIEW

BROAD STOCK MARKET ROTATION PUSHED STOCKS HIGHER IN THE THIRD QUARTER

Global stock markets advanced in the third quarter, with major indexes setting new records despite ongoing volatility. (See Figure 1.) A significant rotation occurred as investors shifted away from mega-cap tech names that had driven much of the market's performance earlier in the year and instead focused on value stocks, small caps, and sectors like utilities and industrials. While artificial intelligence continued influencing the market, investor concerns over stretched tech valuations led to more cautious positioning. Despite some pullbacks in big tech—such as Nvidia and Microsoft—the broad market's gains were supported by a wider range of industries.

BONDS RALLIED AS INTEREST RATES DECLINED

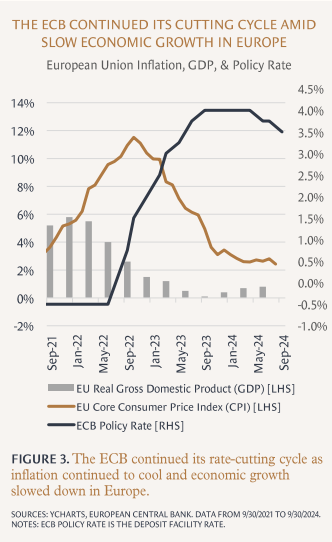

Bond markets delivered solid returns in the third quarter as the U.S. Federal Reserve began reducing interest rates, bringing long-term yields down significantly. With inflationary pressures easing and expectations of continued rate cuts, U.S. bonds saw strong performance, particularly longer-term bonds. International bond markets also experienced a rally, with central banks like the European Central Bank (ECB) signaling further rate cuts amid cooling inflation and economic slowdowns.

MARKET OUTLOOK

STOCK MARKET GAINS LIKELY TO CONTINUE, BUT RISKS REMAIN

Looking ahead, stock market gains could continue, supported by a still solid macroeconomic backdrop and the potential for more accommodative monetary policy as central banks continue easing interest rates. A stable employment landscape, resilient consumer spending, and continued robust business investment should underpin corporate earnings, providing a foundation for further stock market advances. However, with stock valuations at relatively lofty levels, future returns are likely to be more modest.

That said, risks remain. Economic growth could slow more than anticipated as the lagged effects of still relatively high interest rates take hold, despite the Fed and other central banks continuing their rate-cutting campaigns. In addition, volatility is expected to rise as the U.S. presidential election draws closer, with geopolitical tensions, particularly in the Middle East, adding further uncertainty to the outlook.

BONDS POISED TO DELIVER STRONG RETURNS AMID FALLING INTEREST RATES

As we move into fourth quarter and beyond, bond market returns should remain strongly positive as central banks globally continue easing monetary policy. Despite the recent decline in interest rates, bonds still offer relatively compelling yields. Bond returns should continue to be favorable because of these yields and the potential tailwind from further rate declines, amid a gradually slowing economic and labor market environment.

In the U.S., the Fed’s first rate cut signals an official shift toward a more accommodative policy, and additional cuts could follow if the job market and economy continue to slow more than expected. If economic growth slows further, long-term interest rates will likely continue to decline, boosting bond values and improving total returns. However, if inflationary pressures resurface or the economy proves more resilient, the Fed may pause additional rate cuts, maintaining the current high-yield environment. In either scenario, bonds remain compelling for income generation and portfolio diversification going forward.

ECONOMIC REVEW

U.S. ECONOMY CONTINUED TO HOLD STEADY AS FED BEGAN RATE CUTS

The U.S. economy remained resilient in the third quarter of 2024, although signs of moderation emerged. The Federal Reserve began its rate-cutting campaign as inflationary pressures eased and the labor market showed signs of slowing. (See Figure 2.) Consumer spending stayed solid, buoyed by a healthy labor market, but business investment faced headwinds due to higher borrowing costs. Despite some deceleration in job gains, the labor market continued to support overall economic stability, while concerns over a potential recession diminished amid the Fed's cautious shift toward a more accommodative monetary policy stance.

INTERNATIONAL ECONOMIES GRAPPLE WITH SLOWING GROWTH AND STIMULUS MEASURES

Economies outside the U.S. saw varied conditions in the third quarter. In Europe, the ECB (European Central Bank) continued its rate-cutting cycle as inflation showed signs of cooling, although economic growth remained sluggish. (See Figure 3.) Meanwhile, despite some signs of economic resilience earlier in the year, Japan’s economy started to slow down, and the Bank of Japan maintained its accommodative policies to support growth.

China engaged more aggressively in addressing its economic challenges with fiscal and monetary stimulus—aiming to stabilize the property market and meet its 5% growth target—although weak consumer and business spending persisted. Across emerging markets, economic growth varied, with some regions benefiting from the global easing cycle while others faced structural challenges, including geopolitical tensions and weaker demand.

ECONOMIC OUTLOOK

U.S. GROWTH LIKELY TO CONTINUE AMID STABLE CONSUMER SPENDING AND FED POLICY SUPPORT

Looking ahead, the U.S. economy is likely to continue its steady growth path, supported by resilient consumer spending and a stable labor market. Although concerns about potential recession risks remain, the current interest rate environment and economic indicators suggest that the risk of a downturn is limited. Despite uncertainties surrounding the upcoming U.S. presidential election and ongoing geopolitical tensions, key sectors of the economy remain robust. With inflationary pressures easing and the Fed’s rate-cutting campaign likely to continue, this supportive monetary policy should bolster the economic outlook. Barring unforeseen external shocks, the U.S. economy will likely maintain trend-like growth into 2025.

INTERNATIONAL ECONOMIES WILL NEED TO NAVIGATE SHIFTING POLICIES AND REGIONAL CHALLENGES

As we move into 2025, international economic conditions are likely to be shaped by evolving monetary policies and regional dynamics. In Europe, continued rate cuts from the ECB may support economic growth, though a full recovery could depend on stronger consumer demand and business investment. Japan’s accommodative policies should help sustain growth, but demographic challenges and labor shortages may limit long-term expansion. In China, stimulus efforts are expected to remain in focus, with the government aiming to bolster consumer confidence and stabilize key sectors like real estate. Emerging markets could experience uneven growth, with some benefiting from global monetary easing, while others contend with local challenges and geopolitical uncertainties.

ON THE MINDS OF INVESTORS

U.S. ELECTIONS - POTENTIAL MARKET IMPACT AND INVESTMENT CONSIDERATIONS

As the 2024 U.S. presidential and congressional elections approach, investors are increasingly focused on the potential implications for their portfolios. The outcome of these elections could influence policy changes in areas such as taxes, trade, and regulation, which may affect market sectors differently. With a divided Congress and tight presidential race, the balance of power in Washington could shift, making it important for investors to understand the possible scenarios and their impacts on financial markets.

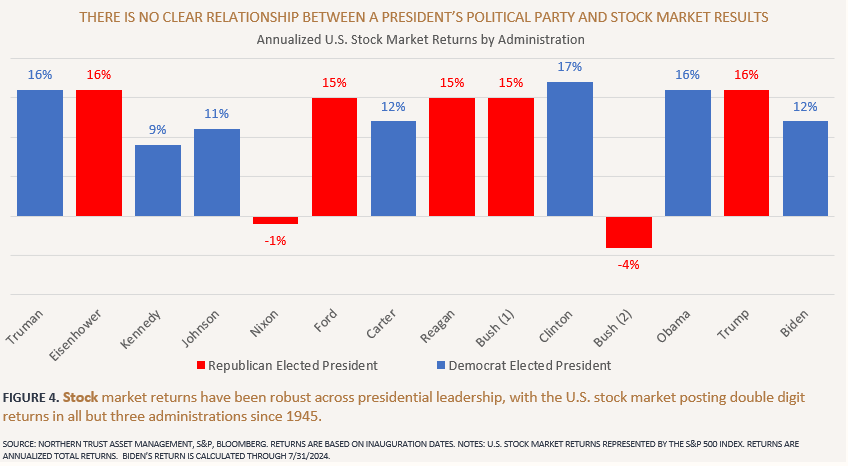

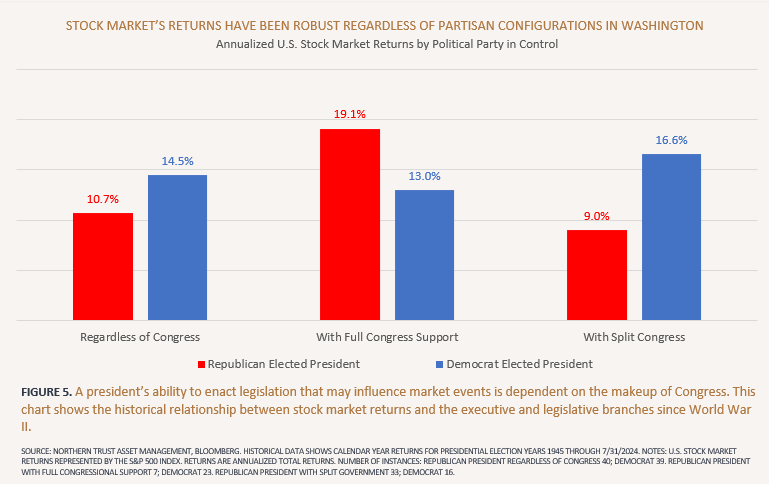

Historically, election results have had less of a direct impact on market performance than one might expect. Data going back nearly a century shows that both Democratic and Republican administrations have presided over positive market returns. Moreover, there is no consistent pattern of outperformance based on which party controls the presidency. (See Figure 4.) This highlights a broader point: markets are driven by factors such as corporate earnings, innovation, and economic growth rather than political outcomes alone.

However, election cycles are often accompanied by increased market volatility. This stems from the uncertainty surrounding potential policy shifts and how they might impact businesses and the broader economy.

Investors typically become more nervous (and cautious), leading to greater short-term fluctuations in stock prices. Additionally, media coverage and polling data can amplify market reactions as investors try to anticipate the outcome. While volatility may rise in the weeks leading up to the election, it is important to note that markets tend to stabilize as election results become clearer.

The potential for policy changes resulting from the election could also lead to varying outcomes for specific sectors.

For example, a Democratic win could result in increased investment and incentives for renewable energy, benefiting that sector, while traditional fossil fuel industries might face more stringent regulations. On the other hand, a Republican win could provide more favorable conditions for traditional energy producers and reduce regulatory burdens. In healthcare, Democrats might push for stricter regulations on drug pricing and expanded access to care, potentially increasing pressure on pharmaceutical companies, while Republicans may favor a more market-driven approach that could benefit insurers and healthcare providers. The financial sector is also likely to see shifts, with changes to tax policies and banking regulations depending on which party holds power. Across sectors, the implementation of new policies may create both opportunities and risks.

The makeup of Congress is another key factor influencing markets. A divided Congress may limit the ability of either party to pass sweeping legislative changes, which could reduce policy uncertainty and be viewed positively by markets. Conversely, unified control of Congress and the presidency may lead to significant policy shifts. However, historical data shows that market returns have been robust regardless of the political permutations in Washington. (See Figure 5.) Whether the government is divided or unified, broader economic fundamentals tend to drive long-term market performance.

In conclusion, while election cycles can increase market volatility, investors should resist the urge to make drastic portfolio adjustments based solely on political developments. Rather than trying to predict the outcome or its immediate market impact, it’s more effective to maintain a long-term investment strategy focused on fundamentals. Whether the election results lead to policy shifts or continuity, history shows that markets adjust accordingly, and staying invested has proven to be a reliable approach.

PORTFOLIO MANAGEMENT

Our portfolio positioning and management recommendations are informed by current market and economic conditions coupled with a long-term investment view. Our current views consider the potential broadening stock market recovery as a global interest rate-cutting cycle commences, balanced with the risks of slowing economic growth and increasing market volatility.

STRATEGICALLY USE STOCK MARKET RALLIES TO YOUR BENEFIT

Stock market rallies, like the one we have experienced this year, present opportunities for long-term investors. It may be tempting to let portfolio stock allocations drift higher when stock markets achieve new all-time highs. However, this may have the unintended consequence of increasing portfolio risk. As such, we recommend that investors stay disciplined and—to the extent they are overweight in their strategic asset allocation targets—use rallies to sell some higher-priced assets and add to other asset classes that have not been performing well. Implementing this disciplined approach of selling high amid market rallies may not feel logical, but it can help improve portfolio risk-adjusted returns over the long term.

MAINTAIN BROAD DIVERSIFICATION WITH A DEFENSIVE TILT WITHIN STOCK ALLOCATIONS

Despite the narrow stock participation for most of this year’s stock market rally, we recommend that investors diversify their stock allocations across various sectors and company sizes. This diversification will enable investors to benefit from further market gains if market participation continues broadening. It will also better protect investors should the few stocks that have rallied the most (and hence may be more expensive) eventually go through a difficult stretch.

Furthermore, we recommend tilting defensively within stock allocations by allocating to more profitable and higher cash flow companies that are relatively less expensive. Profitable and cash-flow-heavy companies that can fund themselves (i.e., not rely on still expensive debt financing), and pay relatively higher dividend yields will likely perform well as interest rates gradually move lower. Moreover, these companies can weather better in a potentially more challenging economic environment.

TAKE ADVANTAGE OF THE CURRENT OPPORTUNITIES IN REAL ESTATE AND INFRASTRUCTURE SECURITIES

As noted in our previous Quarterly Investment Perspective, real estate and infrastructure securities significantly underperformed the broader stock markets, given the significant rise in interest rates over recent years. The prices of real estate and infrastructure securities are particularly sensitive and have an inverse relationship to interest rates. Real estate and infrastructure securities have traded at relatively better valuations than traditional stocks. As such, we have strategically increased allocations to real estate and infrastructure investments in client portfolios. Real estate and infrastructure investments have favorable dynamics from a company fundamentals and investor demand standpoint. Moreover, both asset classes should benefit from a better interest rate backdrop ahead.

EMPHASIZE HIGH-QUALITY, INTERMEDIATE-TERM BONDS

Finally, we recommend that investors strategically allocate most of their bond allocation to investment-grade rated, intermediate-term bonds. This positioning will likely benefit portfolios given the outlook for potentially more challenging economic conditions and central banks continuing to lower interest rates. As the economy continues to slow, bonds issued by companies, governments, and municipalities with a lower probability of default should hold up well. Moreover, the higher yields currently available in intermediate-term bonds enable them to once again act as an effective diversifier against losses in significant down markets for stocks.

SOURCES & ENDNOTES

¹ Notes: U.S. Stock returns are represented by the Russell 3000 Index Total Return (TR) USD. International Stock returns are represented by the MSCI All-Country-World Ex-USA Investible Market Index (IMI) Gross Return (GR) USD. U.S. Bond returns are represented by the Bloomberg Aggregate Bond Index Total Return (TR) USD. International Bond returns are represented by the Bloomberg Global Aggregate Ex-USA Dollar-Hedged Index Total Return (TR) USD.

Past performance does not guarantee future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

IMPORTANT DISCLOSURE INFORMATION

Please remember that different types of investments involve varying degrees of risk, including the loss of money invested. Past performance may not be indicative of future results. Therefore, it should not be assumed that future performance of any specific investment or investment strategy, including the investments or investment strategies recommended or undertaken by Capstone Financial Advisors, Inc. (“Capstone”) will be profitable. Definitions of any indices listed herein are available upon request. Please contact Capstone if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and services, or if you wish to impose, add, or modify any reasonable restrictions to our investment management services. This article is not a substitute for personalized advice from Capstone and nothing contained in this presentation is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. Investment decisions should always be based on the investor’s specific financial needs, objectives, goals, time horizon, and risk tolerance. This article is current only as of the date on which it was sent. The statements and opinions expressed are, however, subject to change without notice based on market and other conditions and may differ from opinions expressed by other businesses and activities of Capstone. Descriptions of Capstone’s process and strategies are based on general practice, and we may make exceptions in specific cases. A copy of our current written disclosure statement discussing our advisory services and fees is available for your review by contacting us at capstonefinancialadvisors@capstone-advisors.com or (630) 241-0833.