Initial Analysis of the Tax Cuts and Jobs Act

Key Points:

The Tax Cuts and Jobs Act includes major tax reform that will impact almost all taxpayers. The new law is aimed at providing simplification, while also strengthening the economy through wide-spread tax cuts for both individuals and businesses.

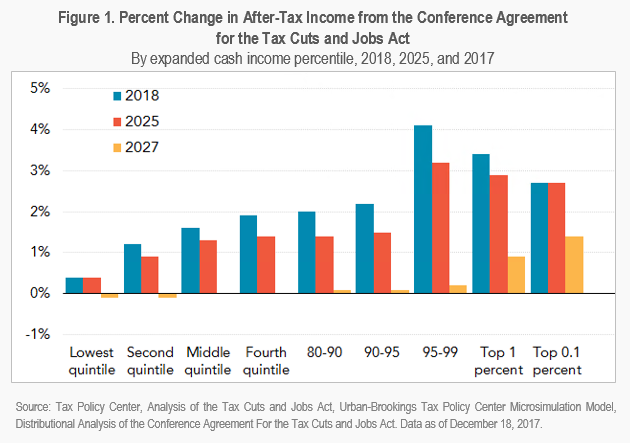

While many of the new limits on Itemized Deductions will significantly reduce or eliminate tax benefits, the new lower tax rates and increase in the standard deduction appear to provide a tax cut on average for most households. Those in a higher income tax bracket will likely see the most benefit.

The new tax law includes a significant tax cut for Corporations and also has many provisions that will affect other business structures such as Partnerships, S Corporations and LLCs, including a deduction for qualified business income.

Introduction

On December 22, 2017, President Trump signed into law the Tax Cuts and Jobs Act. With a new year started, and the new tax law already in effect, some may have different opinions on whether this tax reform is all that it is promised to be. And depending on who you ask, there will also be different opinions on how the Tax Cuts and Jobs Act (TCJA) will ultimately impact the economy. One thing is for certain, the new law will require much more analysis to fully understand all of its ramifications.The TCJA makes some sweeping changes, affecting both individuals and businesses on tax rate structures, allowable deductions, and the availability of certain credits. We have summarized below some of the major provisions that may affect you or your business over the coming year.

What Will the Tax Plan Mean for Individuals?

Lower Tax Rates

The new tax law was intended by Republicans as a major tax cut and simplification. The result of the new law on many will be different, depending upon income level, the type of income earned, state of residence, and family size. And although the provisions do appear to provide a tax cut on average for most households, one early analysis concludes that those in a higher income tax bracket will likely see the most benefit. According to the Tax Policy Center, the largest cut as a share of income is expected to go to taxpayers in the 95th to 99th percentiles of income distribution (i.e. those with income levels between about $308,000 and $733,000). (See Figure 1.)

Adjusted Tax Brackets

Although aiming for simplification, the new law still includes seven different tax brackets consistent with the current rate structure. The new rates are lower, however, with the highest rate being reduced from the current 39.6% to 37% beginning in 2018 (See Figure 2). Instead, the simplification goal of the new law is thought to be addressed by major changes in the treatment of Itemized Deductions and Personal Exemptions.

Increased Standard Deduction

When filing an individual tax return, a taxpayer has the option of reducing their adjusted gross income by either a Standard Deduction or Itemized Deductions, which are the total amount of actual allowed expenses paid during the year that are tax deductible. Whichever deduction, Standard or Itemized, results in the lower total tax would be the best deduction method to select.

The Standard Deduction amount, beginning in 2018, nearly doubles that in 2017, with the total Standard Deduction for joint filers increasing to $24,000 (the Standard Deduction for single filers will increase to $12,000). This increase in the Standard Deduction will reduce the number of taxpayers that would normally utilize their Itemized Deductions. It is thought that this change alone will simplify the filing of a return for a majority of taxpayers. In fact, according to the Joint Committee on Taxation, it is estimated that because of this modification, approximately 94% of taxpayers will claim the Standard Deduction (up from about 70%) rather than itemizing. According to the Conference Report on the law, it is also estimated that this change will cut down on taxpayer costs to prepare returns, and result in a decline in IRS disputes over these itemized deductions.

It should also be noted that along with the increase in the Standard Deduction, the TCJA repeals the use of Personal Exemptions. Under prior law, individuals were allowed a personal exemption, set at $4,050 in 2017, to reduce taxable income. This exemption was available for spouses and dependents, as well. For example, a typical family of four would claim four personal exemptions, amounting to $16,200 in 2017. Personal exemptions are no longer available under the new law.

New Limits on Itemized Deductions

Probably the largest modification from current law, and possibly the most contentious, is the major reduction in allowable state, local and property tax deductions. The final version of the new tax law does allow for a small deduction for taxes, but limits the deduction to $10,000 in total, including all state income and property taxes paid. For many individual filers, this provision alone will remove the benefit of itemizing on their 2018 tax return. For those that live in states with a higher income or property tax rate, this limitation will have a greater negative impact.

The new law retains the mortgage interest deduction, but does limit the deductible interest on new loans up to $750,000, down from the current level of $1.1mm (including $100,000 of home equity debt). The new law disallows a deduction for certain interest paid on home equity loans beginning in 2018. Existing mortgage debt incurred prior to December 15, 2017, other than home equity loans, is grandfathered under the old limits.

The new law retains the deduction for charitable contributions, with some minor modifications. Most charitable contributions will now be limited to 60% of a taxpayer’s Adjusted Gross Income (AGI), an increase from 50% for 2017. Another change added, however, is removing the deduction for donations that are tied to ticket rights for athletic events.

Medical expenses are also retained under the new law, and for 2017-2018 the amount of allowable medical expenses to deduct must exceed 7.5% of AGI, down from the previous 10% hurdle. After 2018, the AGI limit is currently set to revert to the 10% threshold.

Taxpayers will no longer have the ability to claim miscellaneous itemized deductions (subject to the AGI 2% floor) because they are no longer deductible under the new law. Some of the more common deductions included unreimbursed job expenses, investment expenses and tax preparation fees.

Increased Benefit of 529 Plans

While many of the new limits on Itemized Deductions will significantly reduce or eliminate tax benefits resulting in major changes to how some people file their returns, not all of the modifications included in the TCJA do so. There are some taxpayer-friendly provisions in the TCJA that deal with education costs. For example, with the increasing cost of college, the benefits of using 529 Plans for college savings can be invaluable. The new law increases the application of this benefit, expanding to allow for the use of 529 Plans to cover private and public-school tuition for kindergarten through high school, up to a $10,000 limit on an annual basis. There had also been some discussion, to the dismay of many, of disallowing the preferential adjustment to taxable income for student loan interest. The elimination of this adjustment, however, is not included in the new law, and this interest remains as a possible tax benefit.

Increase of Child Tax Credit and Simplification of Kiddie Tax

For those that have children, there are several provisions in the TCJA worth noting. For example, the Child Tax Credit was increased to $2,000 beginning in 2018, with $1,400 of the credit being refundable. In addition, there has been simplification with respect to the “kiddie tax”, which had required a calculation for net unearned income (primarily investment income) reported by a child, subjecting the income to the parent’s tax rate for that year. For tax years after 2017, the kiddie tax system has been simplified. While earned income or wages of children will fall under the normal individual rate structure, unearned income will be subject to the tax rates imposed on trusts and estates. Therefore, under the TCJA, a child’s tax rate will be unaffected by their parent’s rate for that year.

Health Insurance

The TCJA includes a change to the penalties that can be assessed related to health care coverage. Under prior law, taxpayers were subject to penalty on their individual income tax return due to a lack of minimal health insurance, as provided under the Affordable Care Act. Under the TCJA, the individual mandate penalty has been removed after 2018.

Alternative Minimum Tax (AMT) Retained

Not all proposals for the tax bill came to fruition. Although originally slated for repeal, the Alternative Minimum Tax (AMT) was ultimately retained for individual taxpayers. However, it is anticipated that fewer taxpayer’s will fall into this alternative tax system, with the changes to itemized deductions referenced above, and increased AMT phase outs under the new law.

Increase in Estate Tax Exemption

While there was much discussion of a total repeal of the federal estate tax, the final version of the TCJA retains the system, but does increase the total exemption from $5.6mm to $11.2mm in 2018. This increase, however, is set to expire in 2025. It should also be noted that many states continue to have their own estate tax systems, which do not always conform to federal rules. This will necessitate continued planning for many estates.

Expiration Dates

One major difference between the provisions in the TCJA that affect individuals in comparison to businesses are the expiration dates of the changes. While most business provisions are permanent, most of the individual changes are set to expire in 2025. This could have a detrimental effect on many taxpayers.

Estimates of How the TCJA Will Be Applied

So how will all of these changes actually affect an individual’s after-tax income? See Figure 3 to the left for some examples of different scenarios or family structures, with estimates of how the TCJA will be applied, both before and after the expiration of certain provisions.

What Will the TCJA Mean for Businesses?

While there are many changes for individuals that have very broad reaching consequences, the TCJA includes many provisions that affect businesses as well. In fact, a large part of President Trump’s agenda was to push for more favorable rules related to businesses and business owners.

The most significant change for businesses included in the TCJA is the decrease in the corporate tax rate from 35% to 21%, beginning on January 1, 2018. This provision was one of the biggest promises made by President Trump when promoting his tax agenda. There are some that feel that this rate decrease will harm the economy in the long run, with this lower rate causing additional increases in the deficit. The Republicans that pushed this bill through, however, believe the rate cut is necessary to keep the United States competitive with foreign markets, and the tax savings will result in additional capital being added to the economy, resulting in jobs (the “trickle down” theory). (Please read our 1st Quarter 2018 Investment Perspective for more about the potential impact of the TCJA on the economy and the markets.)

However, not all businesses are structured as Corporations. In fact, the Partnership, S Corporation and LLC structures are extremely popular today for businesses. In an attempt to keep these entity structures in similar standing with the tax benefit provided to Corporations, the TCJA also includes a 20% deduction for “qualified business income” from certain pass-through entities. The benefit provided by this deduction has several limitations and income level phase-outs, and the calculation of the allowable deduction can be complicated. There are also additional limitations applied to certain service businesses. Many of the limitations are aimed at deterring high-income taxpayers from attempting to convert wages into income eligible for the deduction. It should also be noted that according to the TCJA, this deduction will be a reduction to taxable income, not adjusted gross income, and will therefore not provide a benefit for many state income tax calculations, including Illinois. This provision is also set to expire after 2025.

Other business provisions include an increase to the Section 179-expensing limitation from $500,000 to $1,000,000, limitations on the deductibility of interest expense, the elimination of the domestic production activities deduction, and the repeal of the Corporate AMT.

More to Follow

The signing of the bill into law will most likely not be the end of the process for the TCJA. There will continue to be much more analysis on the details, with Congress and Treasury possibly addressing needed technical corrections and in many cases regulations to provide guidance on the new provisions. In fact, at the time of this writing, there is already some discussion on the application of the property tax deduction, and how accelerated tax payments will be treated for 2017.

We will continue to monitor the status of these possible changes or additional interpretations of the new law, and communicate these issues to you. If you should have any questions regarding the TCJA and its application to your personal situation, please contact your Capstone service team.

Sources

IRS, Prepaid Real Property Taxes May Be Deductible in 2017 if Assessed and Paid in 2017

Tax Foundation, 2018 Tax Brackets

Tax Foundation, 2018 Tax Brackets (Updated)

Tax Policy Center, Distributional Analysis Conference Agreement Tax Cuts and Jobs Act

Tax Policy Center, TPC Shows How New Tax Law Would Affect Different Households

Tax Policy Center, Updated Effects of the Tax Cuts and Jobs Act on Representative Families