Recession – Is an Economic Downturn Likely if Rates Stay Unchanged For Longer?

KEY POINTS

Global stock markets gained in the second quarter, reaching new all-time highs and building on the positive returns for the year. Meanwhile, global bond market returns inched slightly higher in the second quarter. Looking ahead, we discuss why stock market gains could continue more modestly and why bond market returns will likely improve.

The U.S. economy remained strong amid continued job growth and spending. The Federal Reserve did not cut interest rates as the decline in inflation stalled. Looking ahead, we discuss why the U.S. economy will likely remain steady and why the international economic outlook is mixed.

The Fed will likely continue its wait-and-see approach until it observes consistent signs of cooling in inflation. We discuss whether the economy will eventually enter a recession if interest rates remain unchanged.

We are making some strategic sub-asset-class allocation changes across client portfolios. We discuss why we are increasing allocations to U.S. stocks, real estate, and infrastructure, while reducing allocations to international stocks.

VIEW A SHORT SUMMARY VIDEO

MARKET REVIEW

MEGA-CAP TECH STOCKS CONTINUED TO DRIVE STOCK MARKET GAINS

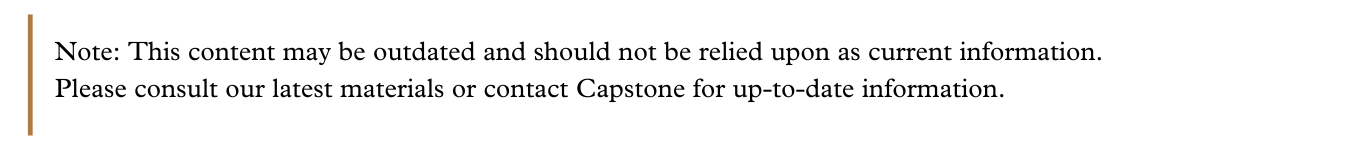

Global stock markets gained in the second quarter, reaching new all-time highs and building on the positive returns for the year. (See Figure 1.) Outsized gains in large-cap growth stocks --particularly from a handful of U.S. mega-cap tech companies benefitting from artificial intelligence-driven demand-- boosted broad market performance. Despite elevated geopolitical and political uncertainty worldwide, overall stock market volatility remained subdued amid a healthy macroeconomic environment, solid corporate earnings growth, and resilient profit margins.

BOND MARKET RETURNS REMAINED MUTED

Global bond market returns inched slightly higher in the second quarter but, in aggregate, are relatively flat on the year.² Longer-term interest rates generally increased across global developed markets in the first half of 2024, pushing down bond prices and offsetting most of their interest income return. The rise in longer-term interest rates reflected broadly resilient economic activity and persistent inflation, particularly in the U.S. Given the relative strength of the U.S. economy, the Federal Reserve (the Fed) pushed off rate cuts, in contrast to some major central banks abroad that started to cut short-term policy rates, including the Swiss National Bank, the Bank of Canada, and the European Central Bank.

MARKET OUTLOOK

STOCK MARKET GAINS COULD CONTINUE; HOWEVER, RETURNS LIKELY MORE MODEST

Looking ahead, the outlook for the stock market is mixed, with the potential for more gains tempered by various potential risks. Strong consumer spending and business investment bolstering corporate earnings would drive further stock market gains. Additional stock market tailwinds could come from continued favorable monetary policy (i.e., interest rates plateau for longer and ultimately decline) and fiscal policy (i.e., more government spending), both of which would support additional economic growth.

However, future returns could be more modest given current lofty stock market valuations and the potential challenges that lie ahead. Stock market declines could ensue if economic growth slows significantly more than expected due to the lagged effects of high interest rates or if inflation flares up materially again, resulting in unexpectedly higher interest rates. Furthermore, stock market volatility will likely rise from low current levels if investor sentiment sours amid a material flare-up in geopolitical conflicts abroad and the potential policy implications of the U.S. presidential and congressional elections.

THE OUTLOOK FOR BONDS REMAINS POSITIVE

Bond market returns will likely improve for the rest of the year and into next year. Although the rise in longer-term interest rates so far this year has dampened bond market returns, it has resulted in even higher yields (in the range of 5.10%-to-6.28%)³ for intermediate-term bonds. Higher yielding bonds are more insulated from further rate increases, which is a less likely scenario considering some central banks abroad have started to cut interest rates and the Fed still indicating they will eventually do the same.

In the U.S., the higher probability scenarios for the next Fed move(s) will either be to keep its short-term policy rate where it is (in the range of 5.25%-to-5.50%)⁴ for longer or to lower it. If inflation no longer shows signs of cooling and economic growth accelerates, then the Fed will likely keep its policy rate high for longer. In this scenario, investors will continue benefiting from attractive bond interest yields. On the other hand, if inflation moderates and economic growth languishes, interest rates (both short-term and long-term) will likely decline gradually. In this scenario, bond values would appreciate, particularly for longer-maturity bonds, adding to investor returns.

ECONOMIC REVEW

U.S. ECONOMY REMAINED STRONG AMID CONTINUED JOB GROWTH AND SPENDING

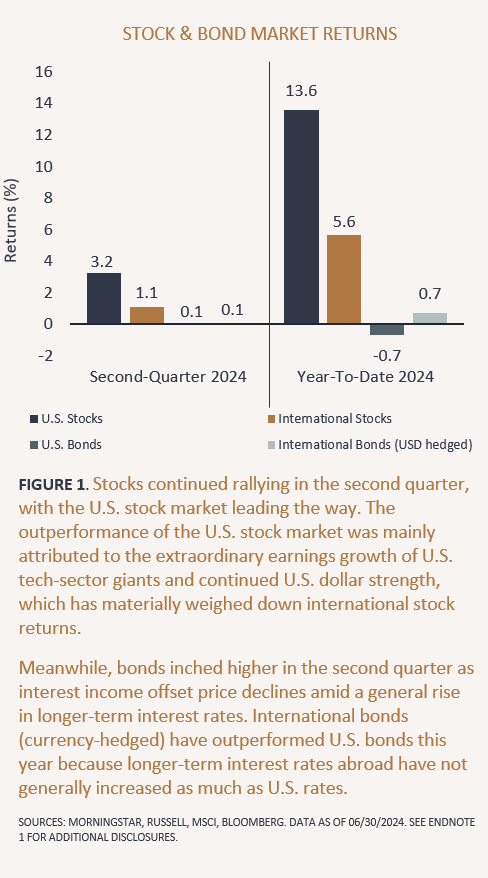

In the first half of 2024, the U.S. economy showed resilience supported by strong job creation and consumer activity despite high interest rates and elevated inflation. The labor market continued adding a significant number of new jobs every month. (See Figure 2.) Consumer spending remained strong, driven by still solid wage increases and the depletion of pandemic-era savings. Inflation showed signs of moderation but stalled between 3%-to-3.5% throughout most of the year’s first half, leading the Fed to maintain a cautious stance and not cut interest rates.

ECONOMIES ABROAD FACED NUMEROUS CHALLENGES

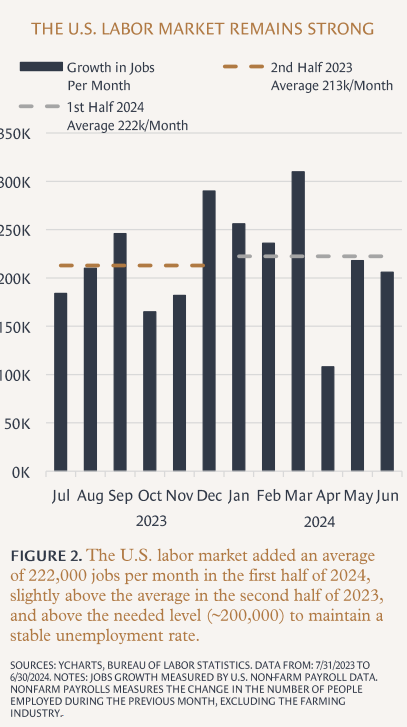

In the first half of 2024, growth in China faltered due to a crisis in the housing sector, leading to various government measures to stimulate the economy. The Eurozone struggled with slow economic growth and elevated inflation despite some improvements. The risk of recession in the Eurozone remained high, worsened by ongoing geopolitical conflicts and high energy costs. Japan stood out as its economy continued to grow above potential amid solid consumer spending activity and a healthy level of inflation, ending its long era of negative interest rates policy. (See Figure 3.) Broadly, ongoing global conflicts and major elections compounded economic uncertainty, negatively impacting global supply chains and consumer confidence.

ECONOMIC OUTLOOK

THE U.S. ECONOMY WILL LIKELY REMAIN STEADY

Looking ahead, the U.S. economy will likely continue showing resilience, supported by strong consumer spending and a robust labor market. As such, the Fed is likely to maintain a cautious stance on monetary policy, with potential rate cuts contingent on further improvements in inflation. Inflation is likely to start moderating again, although it may remain above the Fed's target in the near term. Moreover, government policies such as infrastructure investment initiatives⁶ are anticipated to provide additional support for economic growth.

INTERNATIONAL ECONOMIES FACE A MIX OF CHALLENGES AND OPPORTUNITIES AHEAD

Overall, the international economic outlook remains cautious, with regions adjusting to their unique set of challenges and policy responses.

Going forward, China is likely to see some stabilization due to recent government measures aimed at stimulating the economy, particularly in the housing sector, but underlying issues such as high debt levels and weak consumer confidence may persist. The Eurozone will likely continue to grapple with slow growth and high inflation, with recession risks remaining elevated. However, ongoing efforts to achieve energy independence and boost renewable energy investments could help stimulate economic growth.

Japan’s positive growth momentum could continue, but the Bank of Japan will have to carefully navigate a transition in its monetary policies. As Japan’s central bank tries to move further away from negative interest rate and yield curve control policies, it will need to manage the transition carefully to avoid market disruptions.

Meanwhile, geopolitical tensions, especially those involving China, Russia, and the Middle East, add an additional layer of uncertainty to the global economic landscape. Supply chain fragmentation and trade barriers are likely to impact global growth.

ON THE MINDS OF INVESTORS

RECESSION – IS AN ECONOMIC DOWNTURN LIKELY IF RATES STAY UNCHANGED FOR LONGER?

As we mentioned earlier, the Fed maintained a cautious stance on monetary policy (i.e. the Fed didn’t cut its policy interest rate) during the first half of the year. The Fed will likely continue this approach until it observes consistent signs of cooling inflation. Thus far, the Fed’s plan of keeping interest rates high for longer has slowed the economy somewhat but has not yet caused an official recession. This situation raises the question of whether the economy will eventually enter a recession if interest rates remain unchanged and there are no other external shocks.

Economists generally agree that the typical lag for the effects of monetary policy to be fully felt in the economy is around 12-to-18 months. The Fed raised interest rates between March 2022 and July 2023, so we are now firmly in that 12-to-18-month range with minimal signs of a looming recession (mild or otherwise). It’s possible that the typical monetary policy effect lag will take longer this time.

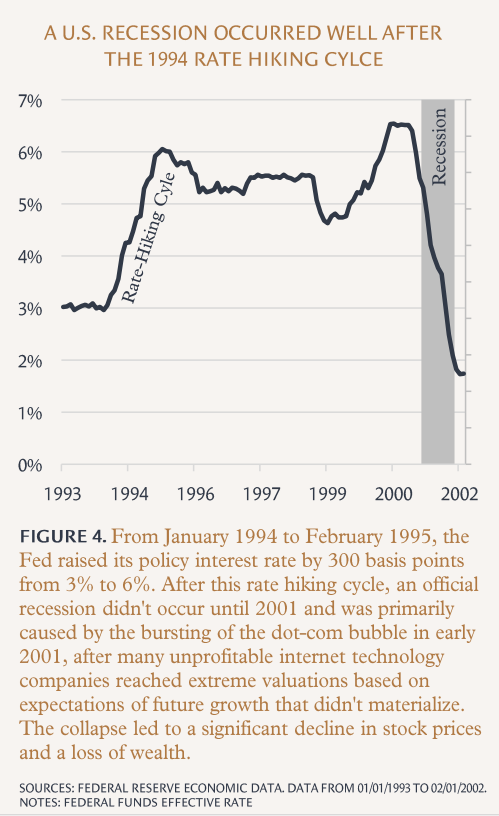

However, it’s also possible that the further we get away from the rate hike period without a recession, the risk of one decreases (absent of another cause) as businesses and consumers continue adjusting to the high rate environment and economic activity continues. In this scenario, a significant market bubble or severe market imbalance would need to form and ultimately burst or correct. This scenario happened after the 1994 rate-hiking cycle. (See Figure 4.)

Furthermore, if the Fed starts cutting interest rates before a recession occurs, that would further lower the risk of a downturn or delay it more. At this point, without a major market bubble or a severe imbalance forming, we think a near-term recession would occur only if the Fed actually resumes rate increases. But as we stated earlier, another rate hiking scenario is less likely at the moment. More rate hikes would only occur if the Fed saw inflation starting to reaccelerate or determined that inflation was no longer falling further to the Fed’s 2% target.

PORTFOLIO MANAGEMENT

Our portfolio positioning and management recommendations are informed by current market and economic conditions coupled with a long-term investment view. As such, we are making some strategic sub-asset-class allocation changes across client portfolios while maintaining client-specific targets to overall "Growth" and "Defensive" assets. Specifically, we are making the following sub-asset-class allocation changes within Growth assets.

STRATEGICALLY INCREASE ALLOCATIONS TO U.S. STOCKS

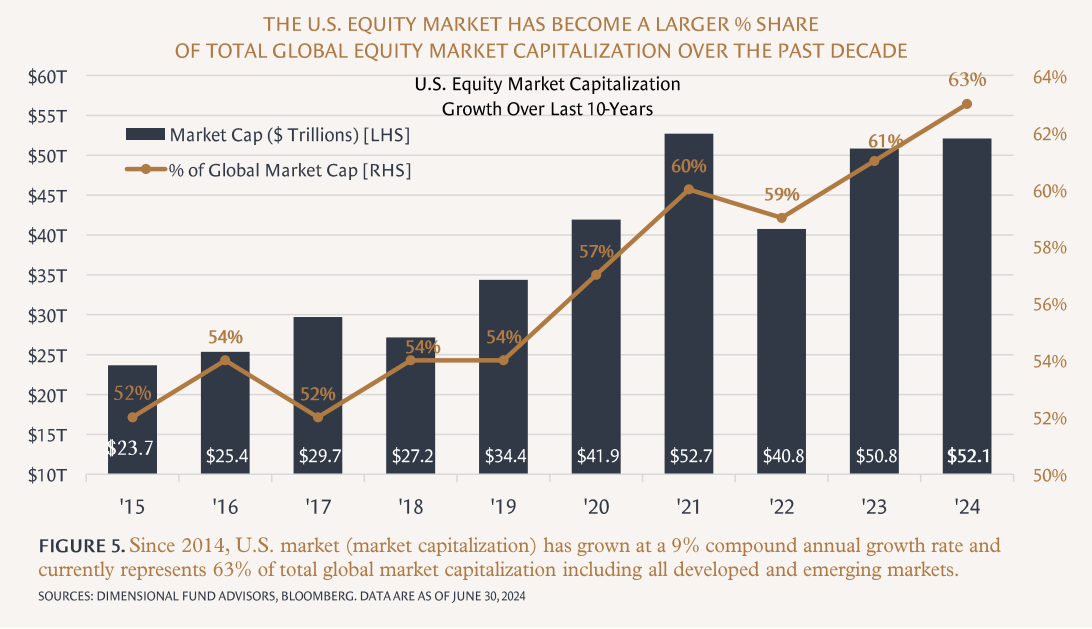

First, regarding market structure, the size of the U.S. stock market has increased materially in recent years relative to the international stock market abroad. (See Figure 5.) The substantial growth of large U.S. companies (especially some of the very largest companies) has been a key contributor to the U.S. stock market's increased proportion. Moreover, given the global reach and international-based earnings of most large U.S. companies, the U.S. stock market can be considered an indirect way to get some exposure to international consumers, markets, and economies.

Because of reasons tied to current market structure and long-term growth potential, we are strategically increasing allocations to U.S. stocks.

Second, the U.S. economy is well-positioned for future growth. The U.S. economy stands to benefit from favorable monetary and fiscal policy in the years ahead. Given the current level of interest rates, further rate hikes (if needed to contain inflation further) would likely be minimal, and rate cuts (if necessary to stimulate the economy) would be a tool that the Fed can once again use. Moreover, the U.S. economy will continue benefiting from favorable fiscal policy tied to already-passed landmark infrastructure investment legislation in the years ahead. The 2021 Infrastructure Investment and Jobs Act, the climate and energy provisions of the 2022 Inflation Reduction Act, and the 2022 CHIPS Act will likely stimulate economic growth over several years by enhancing infrastructure, promoting renewable energy projects, and advancing semiconductor manufacturing.

Lastly, tying the first two points together, many technological breakthrough trends are emerging and being pushed forward in the U.S. The U.S. remains one of the best countries to do business, retaining and attracting the best and brightest people worldwide. So many technology trends happening today (e.g., artificial intelligence (AI), healthcare innovation, robotics, electric and self-driving vehicles, and digitalization broadly) originated and are led by U.S. companies. As such, U.S. companies and the broader economy would likely sooner and more significantly benefit from these technological advances, particularly AI. This could lead to many beneficial business transformations and significant productivity gains in the long term.

STRATEGICALLY INCREASE ALLOCATIONS TO REAL ESTATE AND INFRASTRUCTURE INVESTMENTS

For many years, Capstone has incorporated real estate and infrastructure investments within client portfolios, given their diversification, balanced return, and inflation-hedging characteristics.

Real estate and infrastructure investments are ultimately tied to the value and income-production of physical assets, making them distinct and not highly correlated to traditional stock and bond investments. Additionally, real estate and infrastructure investments provide returns that are a more balanced combination of income (from contracted revenue streams) and growth (from asset value appreciation).

Lastly, both the value (due to embedded cost inflation) and cash-flow (given inflation-linked contracts and leases) from real estate and infrastructure investments tend to increase in line with average inflation levels over time.

Moreover, as we noted in our previous investment perspective commentary, real estate and infrastructure investments have significantly underperformed the broader stock markets, given the significant rise in interest rates over the past two years. The prices of real estate and infrastructure investments are particularly sensitive and have an inverse relationship to interest rates. As such, real estate and infrastructure investment values have been under pressure over the last two years and are currently trading at significant valuation discounts. This recent poor performance has created attractive opportunities for additional investment into these asset classes.

Lastly, the return outlook for real estate and infrastructure asset classes is positive.

Outside of the office sector, commercial real estate stands to benefit from favorable supply and demand dynamics, given high occupancy rates, above-average rent growth, and a lack of oversupply across most major sectors.

Infrastructure also has some favorable dynamics working in its favor, including increased spending and investment to enhance existing and develop new infrastructure. Furthermore, the infrastructure asset class will likely benefit from the major trends, including the continued digitization of societies and economies, the global energy transition, and generative AI, which will require investment and expansion in the power infrastructure market.

STRATEGICALLY REDUCE BUT MAINTAIN ALLOCATIONS TO INTERNATIONAL STOCKS

International stock allocations will be reduced to increase U.S. stock, real estate, and infrastructure allocations. However, international stock allocations will remain a strategic part of client portfolios.

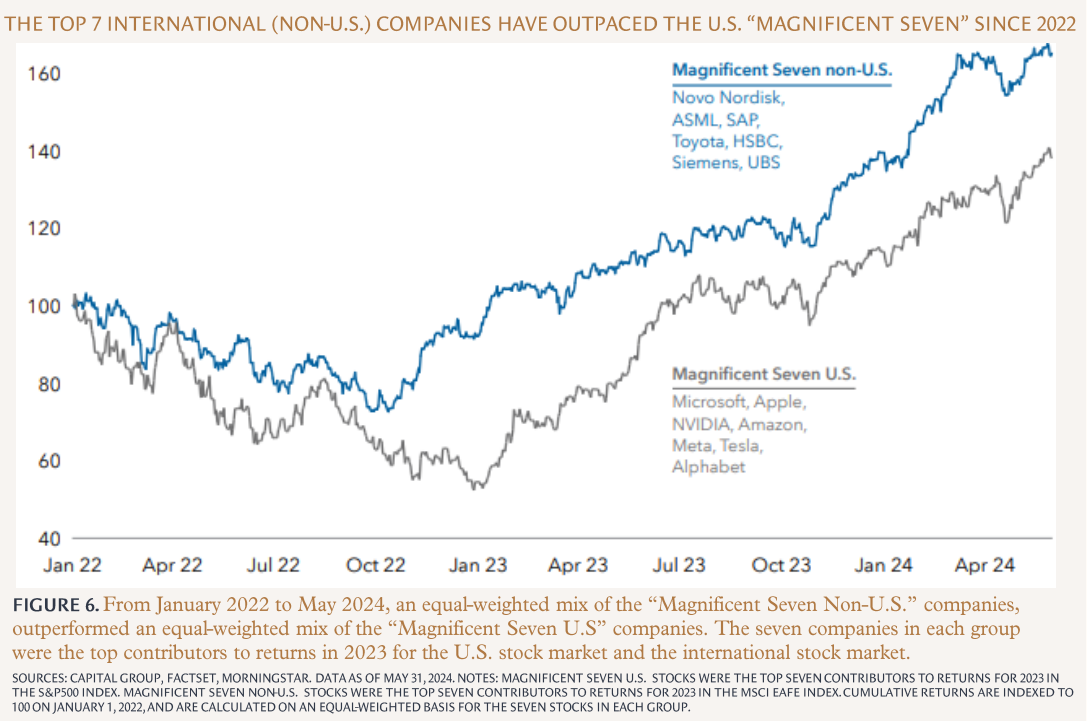

Although the U.S. stock market has increased proportionally, the international stock market is still a large part of the global equity market. In fact, some of the world's largest and most successful (and best performing) companies are based internationally. (See Figures 6 & 7.) As such, investing in stock markets abroad meaningfully expands the opportunity set.

Moreover, international stock allocations help to diversify portfolios. This diversification includes reducing the mega-cap stock concentration risk and achieving better balance across sectors, given that international markets have a distinct sector mix from the U.S. market. Additionally, international economies are typically at different parts of an economic cycle relative to the U.S., which can help offset the potential risk of an eventual recession (and bear market) in the U.S.

OUR INVESTMENT DECISION-MAKING AND IMPLEMENTATION PROCESS

When it comes to making client portfolio changes, Capstone is very deliberate in its investment decision-making processes. We thoroughly research and evaluate historical data when making asset allocation changes. We also assess clients' tax situations to ensure that a portfolio change's potential benefit will be worth the cost within a reasonably short breakeven period. These assessments and portfolio changes will begin to be implemented over the next few weeks. As always, please do not hesitate to reach out to us should you have any questions.

SOURCES & ENDNOTES

¹ Notes: U.S. Stock returns are represented by the Russell 3000 Index Total Return (TR) USD. International Stock returns are represented by the MSCI All-Country-World Ex-USA Investible Market Index (IMI) Gross Return (GR) USD. U.S. Bond returns are represented by the Bloomberg Aggregate Bond Index Total Return (TR) USD. International Bond returns are represented by the Bloomberg Global Aggregate Ex-USA Dollar-Hedged Index Total Return (TR) USD.

² Sources: Bloomberg, Morningstar. The global bond market, represented by the Bloomberg Global Aggregate Bond Index TR Hedged USD, had a total returns of 0.13% year-to-date through 06/30/2024.

³ Sources: Bloomberg, JPMorgan. Data as of 06/30/2024. Notes: The yield-to-worst for the Bloomberg U.S. Aggregate Index, a benchmark for the taxable U.S. investment grade bond market, was 5.00%. The taxable-equivalent yield-to-worst for the Bloomberg Municipal Index, a benchmark for the tax-exempt U.S. investment grade bond market, was 6.28% based on a 40.8% total federal tax rate (37% plus 3.8% net investment income tax).

⁴ Sources: Federal Reserve. Data as of 06/30/2024. Notes: The target Federal Funds Rate lower limit is 5.25% and the upper limit is 5.50%.

⁵ Source: Bureau of Labor Statistics. Data as of 06/30/2024. Notes: U.S. inflation as measured by the headline U.S. Consumer Price Index (CPI).

⁶ Infrastructure investments in the U.S. include initiatives under landmark legislation such as the bipartisan Infrastructure Investment and Jobs Act of 2021 and the Inflation Reduction Act (IRA) and CHIPS Act of 2022.

Past performance does not guarantee future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

IMPORTANT DISCLOSURE INFORMATION

Please remember that different types of investments involve varying degrees of risk, including the loss of money invested. Past performance may not be indicative of future results. Therefore, it should not be assumed that future performance of any specific investment or investment strategy, including the investments or investment strategies recommended or undertaken by Capstone Financial Advisors, Inc. (“Capstone”) will be profitable. Definitions of any indices listed herein are available upon request. Please contact Capstone if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and services, or if you wish to impose, add, or modify any reasonable restrictions to our investment management services. This article is not a substitute for personalized advice from Capstone and nothing contained in this presentation is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. Investment decisions should always be based on the investor’s specific financial needs, objectives, goals, time horizon, and risk tolerance. This article is current only as of the date on which it was sent. The statements and opinions expressed are, however, subject to change without notice based on market and other conditions and may differ from opinions expressed by other businesses and activities of Capstone. Descriptions of Capstone’s process and strategies are based on general practice, and we may make exceptions in specific cases. A copy of our current written disclosure statement discussing our advisory services and fees is available for your review by contacting us at capstonefinancialadvisors@capstone-advisors.com or (630) 241-0833.