New Tariffs Spark Uncertainty—What It Means For Markets And The Economy

KEY POINTS

U.S. stocks pulled back in the first quarter, while international stocks continued their upward climb. Bond markets delivered solid results in the first quarter, offering a cushion to diversified portfolios amid stock volatility. Looking ahead, we discuss why market volatility will likely remain elevated with the potential for more downside and upside swings.

The U.S. economy showed continued resilience in the first quarter of 2025, despite a wave of negative headlines tied to trade policy and market volatility. Our outlook discusses why we expect the U.S. economy to slow in the months ahead as ongoing policy uncertainty weighs more noticeably on consumer and business activity.

The April announcements by the White House of sweeping new tariffs on U.S. imports sparked a wave of concern among investors and ensuing severe market volatility—and understandably so. We discuss what these changes could mean for the market and economy going forward.

Finally, we discuss why maintaining a diversified, goal-aligned portfolio is critical during periods of heightened uncertainty. Market pullbacks can be unsettling, but they also create opportunities for strategic investment moves like tax-loss harvesting, rebalancing, and dollar-cost averaging.

MARKET REVIEW

TARIFF TENSIONS WEIGH ON U.S. STOCKS AS INTERNATIONAL MARKETS DIVERGE

Following a blockbuster 2024, equity markets hit a speed bump in the first quarter of 2025. U.S. stocks declined amid growing investor unease over the potential for sweeping trade restrictions, as early signals from the new administration stirred fears of a broader tariff regime. (See Figure 1.) Although the official announcement came in early April, markets had already begun to react in Q1, with policy uncertainty and stretched valuations sparking the start of a sharp correction, particularly in growth-oriented and mega-cap technology stocks. Meanwhile, international markets found their footing, with Europe and parts of Asia outperforming thanks to fiscal stimulus, defense spending, and a weaker U.S. dollar—factors that helped offset global policy uncertainty and revived investor appetite for diversification.

STRONG U.S. BOND GAINS PROVIDE STABILITY AMID STOCK MARKET SWINGS

Bond markets delivered solid results in the first quarter, offering a cushion to diversified portfolios amid stock volatility. U.S. bonds posted strong gains as cooling economic momentum and elevated policy uncertainty prompted investors to seek safety, helping push longer-term interest rates lower. While inflation data remained mixed, expectations for future Fed rate cuts remained intact, further supporting bond returns.

Outside the U.S., bond markets were more muted, with international bonds finishing the quarter down slightly as diverging central bank policies and currency effects offset falling rates in some regions.

MARKET OUTLOOK

VALUATION RESET MAY IMPROVE RETURN POTENTIAL AMID ONGOING VOLATILITY

Looking ahead in the U.S., heightened policy uncertainty—especially around tariffs—is likely to remain a key source of volatility. Stock markets will continue to grapple with the effects of elevated inflation, shifting economic growth expectations, and pressure on corporate earnings. As investors adjust to shifting conditions, markets will continue to reprice risk across sectors and styles—particularly among companies facing pressure from trade policy, rising costs, or stretched valuations.

Market volatility will likely remain elevated into the second quarter, with the potential for more downside and upside swings. Further downside could stem from prolonged policy uncertainty, weaker-than-expected earnings guidance, or signs that inflation remains persistently high, limiting the flexibility of central banks. On the other hand, sharp rebounds could occur if policy developments or economic data come in better than feared. Given this backdrop, we anticipate markets will stay choppy in the near term but expect uncertainty to ease as we move closer to the second half of the year. Given the significant repricing that has already occurred, particularly in U.S. equities, we believe the setup for near-term forward returns is becoming more favorable—especially if earnings hold up better than expected or if policy clarity improves.

International stock markets may continue to offer relative appeal in the quarters ahead. A weaker dollar, compelling valuations, and supportive fiscal measures—particularly in Europe and China—could continue to provide a tailwind. While global markets face many of the same macro risks as the U.S., several regions may be better positioned to weather near-term disruptions due to their lower valuations and more domestically driven revenue bases. We continue to see a strong case for geographic diversification in stocks, particularly as international markets demonstrate greater resilience and potential leadership amid today’s U.S. policy uncertainties.

ELEVATED YIELDS AND ECONOMIC UNCERTAINTY BOLSTER THE CASE FOR HIGH-QUALITY BONDS

Bonds continue to offer compelling value as we head into the second quarter, with yields remaining elevated and the potential for capital appreciation should economic growth slow or market volatility persist. Despite the uncertain backdrop, we believe bonds, particularly high-quality bonds, remain well-positioned to serve as a resilient foundation for portfolios—providing both income and ballast.

While the timing and pace of central bank rate cuts remain fluid, the broader interest rate environment appears to be shifting gradually in favor of bondholders. High-quality bonds could benefit from renewed downward pressure on interest rates if inflation moderates or the economic outlook deteriorates. In the meantime, elevated starting yields alone offer investors a meaningful cushion and attractive return potential in the future.

ECONOMIC REVEW

U.S. ECONOMIC MOMENTUM HELD UP IN Q1 AMID GROWING POLICY UNCERTAINTY

The U.S. economy showed continued resilience in the first quarter of 2025. Despite a wave of negative headlines tied to trade policy and market volatility, most economic data pointed to a steady pace of activity. The labor market remained solid, retail sales grew at a healthy rate, and business investment was generally stable, particularly in the early part of the quarter.

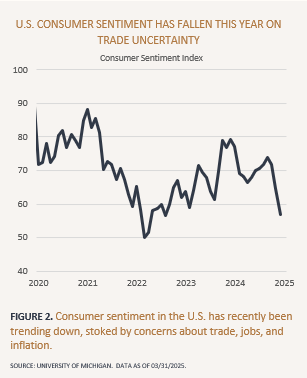

However, signs of moderation began to emerge as the quarter progressed. Several key sentiment surveys pointed to softening expectations among consumers and businesses, particularly in response to rising policy uncertainty and the potential impact of higher tariffs. (See Figure 2.) These early signals, coupled with the pressure of still elevated inflation and higher borrowing costs, suggest a cooling trend had begun to take shape.

INTERNATIONAL ECONOMIC GROWTH EDGED HIGHER AMID POLICY SUPPORT AND UNEVEN RECOVERY

Outside the U.S., economic conditions were mixed but generally stable, with several major economies showing early signs of recovery. In Europe, growth was supported by increased government spending, especially in infrastructure and defense, while consumer activity remained relatively steady despite persistent inflation. In Asia, momentum varied by country, but China’s recent stimulus measures and easing financial conditions improved confidence and domestic activity.

Still, many international economies continued to contend with elevated input costs and trade-related disruptions. While regional differences were notable, overall global growth during the quarter reflected a modest rebound from the sluggish conditions in late 2024. This improvement was partly supported in part by policy stimulus and increased demand in areas such as construction, travel, and industrial production.

ECONOMIC OUTLOOK

U.S. GROWTH EXPECTED TO SLOW, BUT SHARP CONTRACTION NOT ANTICIPATED

We expect the U.S. economy to slow in the months ahead as ongoing policy uncertainty weighs more noticeably on consumer and business activity. While future inflation is difficult to predict, elevated import costs suggest some upward pressure on prices may persist. Prolonged trade tensions could delay business investment, while further price increases tied to tariffs may strain household budgets.

That said, the starting point for the U.S. economy remains relatively solid: consumer balance sheets are in good shape, and corporate fundamentals are generally healthy. These factors should help cushion the economy and support a gradual deceleration rather than a sharp contraction or broad-based recession. If overall inflation—including housing and energy—remains contained or begins to ease, and labor market conditions remain stable, the slowdown could be relatively modest. Nonetheless, the chance of a recession has increased given the current headwinds, and the outlook remains sensitive to policy developments and, ultimately, continued shifts in consumer and business confidence.

GROWTH OUTLOOK REMAINS UNEVEN AS TRADE POLICY AND FISCAL SUPPORT SHAPE REGIONAL TRAJECTORIES

Outside the U.S., the growth outlook remains mixed, with regional variation tied closely to each country’s fiscal capacity and exposure to global trade. In Europe, stimulus efforts have helped support industrial and infrastructure activity, though inflation remains elevated and consumer confidence somewhat fragile. In Asia, momentum is more varied, but China’s recent policy actions appear to be gaining traction, with early signs of improvement in credit growth, housing activity, and domestic consumption.

Trade policy uncertainty remains a key factor for many global economies, particularly export-oriented regions and those closely tied to U.S. supply chains. These challenges have prompted more targeted economic responses, such as increased public spending and domestic stimulus measures. While a more synchronized global expansion seems unlikely in the near term, such efforts may help cushion some of the external pressures on international growth.

ON THE MINDS OF INVESTORS

NEW TARIFFS SPARK UNCERTAINTY—WHAT IT MEANS FOR MARKETS AND THE ECONOMY

The April 2nd announcement by the White House of sweeping new tariffs on U.S. imports sparked a wave of concern among investors and ensuing severe market volatility—and understandably so. The scope of the Trump administration’s latest trade measures is much broader than what we saw in 2017, with tariffs extending beyond China to include many of the United States’ largest trading partners via a 10% universal tariff, higher add-on country-specific reciprocal tariffs, and various 25% product-specific tariffs.

On April 9th, President Trump announced a 90-day pause on reciprocal tariffs above 10% on countries except China. Furthermore, on April 11th, President Trump temporarily exempted smartphones, computers, and other tech devices and components from the universal and reciprocal tariffs. While the worst-case scenario has likely been avoided, meaningful tariffs remain, which are likely to have implications for the economy and inflation.

While calculations vary, the consensus is that before the April 9th reciprocal tariff pause, the average effective tariff rate on U.S. imports would have risen above 30%. Still, the remaining tariffs could increase the average effective tariff rate to over 25%, which is still much higher than the average 3% effective tariff rate before April 2nd. (See Figure 3.) Although we don’t expect the rate to remain at that level, given the prospect of negotiations and further exemptions, the effective tariff rate is likely to be substantially higher than before the announcement of the latest tariffs.

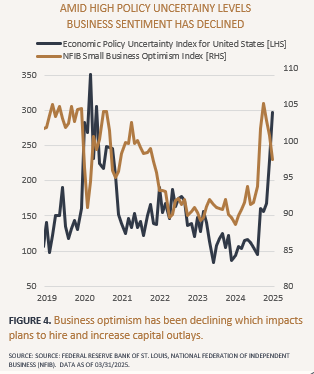

The risk isn’t just about tariffs but how businesses and consumers respond to the uncertainty they create. While day-to-day economic activity has not yet shown significant signs of disruption, there has recently been a meaningful increase in policy uncertainty concerns and business caution. (See Figure 4.) Policy uncertainty influences business and consumer behavior and contributes to significant financial market volatility, which also influences behavior.

That said, some tariffs may ultimately prove temporary if they serve their intended purpose: to bring trading partners to the negotiating table and create stronger long-term agreements. It’s still too early to know how this situation will play out, and investors should expect continued headlines in the weeks and months ahead.

But it’s worth remembering that policy-driven market shocks are not new—and that the U.S. economy and global markets have shown resilience through many complex episodes in the past. While the current environment may feel difficult, we remain hopeful that a negotiated path forward will emerge and that today’s challenges could ultimately pave the way for more durable economic and trade arrangements over time. Long-term investors have consistently been rewarded for maintaining perspective and staying invested through periods of policy change like this.

PORTFOLIO MANAGEMENT

In times of uncertainty, it's natural to feel the urge to make changes—but reacting to short-term market moves often negatively impacts long-term outcomes. The recent pullback in U.S. stocks has been uncomfortable, but it hasn't derailed the broader purpose of a diversified portfolio. Market volatility, while unnerving, is not uncommon and can even create opportunities for disciplined investors. We believe the best course of action is to remain grounded in your long-term goals and to ensure portfolios continue to reflect those objectives.

DIVERSIFICATION AND BALANCE CONTINUE TO MATTER

A well-diversified portfolio—one that includes a broad mix of asset classes, geographies, and sectors—continues to be an essential tool for managing risk. While the recent sell-off has hit certain areas of the market hard, others have held up better. International stocks and bonds have outperformed U.S. markets so far this year, and sectors outside of technology have helped cushion the impact of concentrated weakness in large-cap growth stocks. Having different directionally performing asset classes in a portfolio provides the ability to rebalance into areas that are now more attractively valued. This underscores why broad diversification, rather than concentration in any one area, can be a powerful ally in uncertain times.

TAKE ADVANTAGE OF OPPORTUNITIES TO REDUCE FUTURE TAXES

Periods of market weakness can open the door for proactive tax strategies, including tax-loss harvesting. Realizing investment losses in taxable accounts can help offset gains elsewhere—potentially lowering current or future tax bills. We're monitoring portfolios closely for opportunities to take strategic losses, where appropriate while maintaining the integrity of the overall investment strategy.

STAY INVESTED AND STAY DISCIPLINED

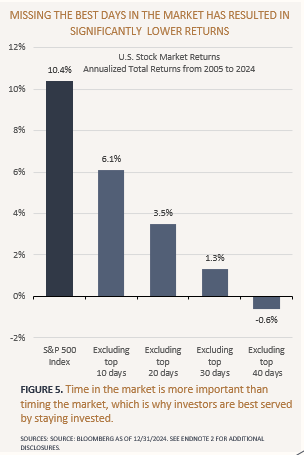

It's tempting to want to time the market or shift to cash until things feel "safe" again—but history has shown that investors who stay the course tend to be better positioned for recovery. Market rebounds often come quickly and without warning, and missing just a handful of the best days can significantly impact long-term returns. (See Figure 5.) Staying invested in a thoughtfully constructed portfolio helps ensure participation in future gains and keeps your plan on track.

LEVERAGE THE POWER OF DOLLAR-COST-AVERAGING

For investors with excess cash (not needed for the foreseeable future), we recommend investing a pre-determined dollar amount on a regular basis to take advantage of currently discounted values for stocks. By “dollar cost averaging,” a common investment strategy, long-term investors can make market downturns work for them in the long run. We recommend continuing contributions when the market is down to purchase more shares at a lower cost.

REVISIT YOUR LONG-TERM PLAN

Periods of uncertainty are a good reminder to revisit your long-term financial plan. Are your goals still the same? Has anything changed in your personal circumstances that might warrant a portfolio adjustment? While making big moves in response to market noise is rarely advisable, thoughtful updates based on evolving needs and priorities can help ensure your portfolio continues to serve its purpose. Although short-term market movements seldom call for strategic allocation changes, a material shift in your financial objective or situation might. If that's the case, please don't hesitate to reach out to us.

SOURCES & ENDNOTES

¹ Notes: U.S. Stock returns are represented by the Russell 3000 Index Total Return (TR) USD. International Stock returns are represented by the MSCI All-Country-World Ex-USA Investible Market Index (IMI) Gross Return (GR) USD. U.S. Bond returns are represented by the Bloomberg Aggregate Bond Index Total Return (TR) USD. International Bond returns are represented by the Bloomberg Global Aggregate Ex-USA Dollar-Hedged Index Total Return (TR) USD. Past performance is not indicative of future results.

² Return data is annualized based on an average of 252 trading days within a calendar year. The year begins on the first trading day in January and ends on the last trading day of December, and daily total returns were used. Total returns assume the reinvestment of dividends, interest, and other cash flows. When out of the market, cash is not invested. Market returns are represented by the S&P 500 index. Top days are defined as the best performing days of the S&P 500 during the twenty-year period. Indexes are unmanaged, do not incur management fees, costs, and expenses, and cannot be invested in directly. Past performance is not indicative of future results.

IMPORTANT DISCLOSURE INFORMATION

Please remember that different types of investments involve varying degrees of risk, including the loss of money invested. Past performance may not be indicative of future results. Therefore, it should not be assumed that future performance of any specific investment or investment strategy, including the investments or investment strategies recommended or undertaken by Capstone Financial Advisors, Inc. (“Capstone”) will be profitable. Definitions of any indices listed herein are available upon request. Please contact Capstone if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and services, or if you wish to impose, add, or modify any reasonable restrictions to our investment management services. This article is not a substitute for personalized advice from Capstone and nothing contained in this presentation is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. Investment decisions should always be based on the investor’s specific financial needs, objectives, goals, time horizon, and risk tolerance. This article is current only as of the date on which it was sent. The statements and opinions expressed are, however, subject to change without notice based on market and other conditions and may differ from opinions expressed by other businesses and activities of Capstone. Descriptions of Capstone’s process and strategies are based on general practice, and we may make exceptions in specific cases. A copy of our current written disclosure statement discussing our advisory services and fees is available for your review by contacting us at capstonefinancialadvisors@capstone-advisors.com or (630) 241-0833.