Investment Perspective Q3 2021: Is Rising Inflation Something to Worry About?

KEY POINTS

Global stock and bond markets posted broad gains in the second quarter. The global recovery is gaining steam, which should continue translating to strong earnings growth and higher stock markets throughout the remainder of the year.

Most U.S. economic data have rebounded to their pre-pandemic levels. In contrast to the U.S., other regions abroad have disappointed expectations so far this year. The outlook for the remainder of the year has the global economy continuing its uneven recovery.

Many goods and service prices have surged in recent months, causing a spike in core inflation to levels not seen since the early 1990s. Regardless of whether the recent rise in prices is temporary or permanent, there are ways investors can help hedge inflation risk in their portfolios and outpace it over the long term.

Over the last few weeks, we have successfully implemented a few changes to align client portfolios with our long-term outlook for global economic acceleration; demand and investment in renewable energy and digital communication infrastructure; and a continued low-interest rate environment.

MARKET REVIEW

A ROBUST RECOVERY HAS CONTINUED TO PUSH STOCK MARKETS HIGHER

Global stock markets posted broad gains in the second quarter (for the fifth consecutive quarter¹) amid continued economic stimulus (both fiscal and monetary) and fading effects from the pandemic. Moreover, global corporate earnings results and forward guidance remained very upbeat amid improving economic data. With such positive economic and earnings momentum, stock market volatility fell to pre-pandemic levels despite inflation concerns and uncertainty over the future course of the U.S. Federal Reserve (Fed) stimulus efforts.

BOND MARKET SIGNS THAT FUTURE GROWTH MIGHT BE MORE MUTED THAN PREVIOUSLY EXPECTED

Global bond markets also gained in the second quarter (see Figure 1), partially reversing their sharp first-quarter decline. The bond market advances were due to interest rates (which move in the opposite direction of bond prices) falling in the second quarter, particularly in the U.S. The recent move down in rates suggests that after snapping back from the Covid-19 shutdown, longer-term economic growth might be more muted than investors expected earlier in the year. The recently reduced enthusiasm could be partly due to concerns about the Covid-19 variant, and uncertainty around President Biden’s proposed government spending plan.

MARKET OUTLOOK

STRONG EARNINGS GROWTH SHOULD CONTINUE DRIVING STOCK MARKETS HIGHER

The global recovery is gaining steam, which should continue translating to solid earnings growth throughout the remainder of the year. The highest earnings growth is likely to come out of more cyclically oriented sectors that tend to be sensitive to the state of the economy. Relative to the U.S., international markets provide greater exposure to this cyclicality. (See Figure 2.) As such, stock markets outside of the U.S. have a longer runway ahead, as we expect peak activity and earnings growth to occur later this year.

STOCK MARKETS WILL LIKELY BE CHOPPIER

As stocks continue into the second year of their bull market run, market volatility is likely to increase compared to the first year. Although the current macro backdrop is still highly supportive for stocks, risks remain, including: elevated U.S. stock valuations; higher-than-expected inflation; new Covid-19 variants that often bypass vaccines; and central bank policy (normalization) error. Moreover, today’s elevated stock valuations may raise correction risk (a decline of 10% or more from peak), but absent renewed recessionary factors, we do not expect a bear market (a decline of 20% or more) anytime soon.

ECONOMIC REVIEW

EVIDENCE CONTINUES TO BUILD OF A ROBUST U.S ECONOMIC RECOVERY

Most U.S. economic data have rebounded to their pre-pandemic levels. Amid eased health concerns, consumers have unleashed their pent-up demand for goods and services to the point where supplies have struggled to keep up, and prices for many goods and services have surged. In addition, income support from enhanced unemployment insurance and government stimulus helped drive spending in the second quarter. Meanwhile, job openings continue to rise while the unemployment rate continues to fall. (See Figure 3.) With these significant economic improvements, the Fed began to telegraph an eventual shift away from the easy-money policies implemented during the pandemic.

INTERNATIONAL ECONOMIC RECOVERY HAS BEEN DELAYED BUT NOT DERAILED

In contrast to the U.S., other regions have disappointed expectations so far this year, primarily due to renewed national restrictions on activity and a slower-than-expected vaccination pace. Since May, however, daily vaccination rates have picked up meaningfully across Europe, Asia, and South America. These continents are now vaccinating a higher percentage of their populations daily than the U.S.⁴ As a result, economic data abroad is improving at a faster rate, particularly in Europe, where COVID-19 restrictions are finally easing.

ECONOMIC OUTLOOK

GLOBAL GROWTH WILL CONTINUE TO BE UNEVEN THIS YEAR

The outlook for the remainder of the year has the global economy continuing its uneven recovery.

The story of the U.S. economy remains one of a robust rebound that will likely result in a full recovery from the pandemic recession by the end of the year. Progress on vaccines will continue to allow for a substantial reopening of sectors that benefit from face-to-face interaction and the economy more broadly. However, we could see a moderation in the U.S. growth rate in the second half of the year as the impacts of government stimulus and pent-up consumer demand wane from current levels.

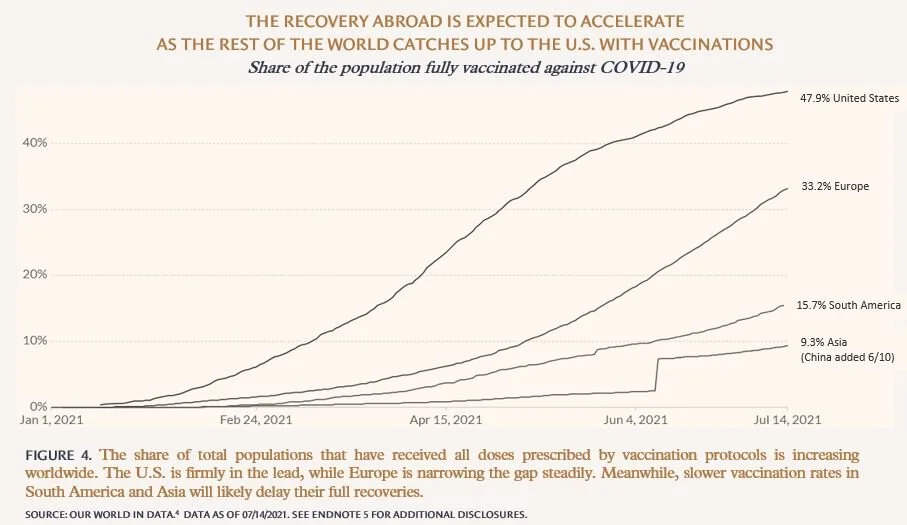

While the rate of recovery in the U.S. is likely to slow down later in the year, the recovery abroad is expected to accelerate. As vaccination rates climb across the world (see Figure 4), many developed market countries should continue to roll out re-opening plans throughout the year. In contrast, many emerging market countries will likely face virus and vaccine challenges for the remainder of the year but should benefit from global economic re-opening and foreign aid.

ON THE MINDS OF INVESTORS

IS RISING INFLATION SOMETHING TO WORRY ABOUT?

Many goods and service prices have surged in recent months, causing a spike in core inflation data to levels not seen since the early 1990s. (See Figure 5.) Booming consumer demand combined with supply shortages and service bottlenecks tied to hiring difficulties are the key reasons behind the move up in prices.

Furthermore, annual (year-over-year) inflation measurements are currently being amplified by comparisons with figures from last year during Covid-19 lockdowns, when prices plummeted because of collapsing demand for many of the same goods and services.

Heading into the second half of the year, investors are weighing whether the recent acceleration in inflation is shaping up to be a short-term effect or the start of a longer-term trend that might force the Fed to pick up its pace of interest-rate increases.

As of this writing, the Fed still firmly believes that the recent rise in prices is due to temporary factors directly related to the economy’s rebound from the pandemic rather than a sustained, significant increase in inflation.

As the year progresses, demand and supply imbalances should normalize in commodities, goods, and services, bringing inflation rates back to normal levels around 2%. Moreover, inflation is unlikely to spiral out of control given excess capacity in the job market and the secular disinflationary forces that remain in place, such as globalization, technology efficiencies, and aging populations.

BUT WHAT IF THE FED IS WRONG?

If the Fed is incorrect, we will likely experience a slightly higher-than-2% sustained level of inflation over the next few years. In this scenario, growth assets like stocks, real estate, and infrastructure are still likely to generate returns that outpace inflation.

On the other hand, cash investments like short-maturity CDs or money market funds will effectively lose money (on an inflation-adjusted basis) because they are currently yielding so little.

Defensive assets, like longer-maturity high-quality bonds, are likely to be challenged initially while interest rates move higher to adjust for inflation. Ultimately though, higher interest rates will result in better future returns for longer-term bonds.

The reality is that the risk of inflation is always present. For investors in the earlier “accumulation stage” of their lives, inflation protection can be effectively provided by salary increases and larger allocations to higher returning growth assets.

In contrast, investors in the later “decumulation stage” should focus on inflation protection by maintaining some allocation to growth assets (albeit smaller) throughout retirement. These investors should also focus on holding, rebalancing into, and reinvesting interest in, longer-maturity bonds.

Regardless of an investor’s situation and outlook on future inflation, staying invested, avoiding market timing, and not keeping a substantial portion of their portfolio in cash, are ultimately the best courses of action in an inflationary environment.

PORTFOLIO MANAGEMENT

Over the last few weeks, we have successfully implemented a few changes to align client portfolios with our long-term market outlook.

GLOBAL ACCELERATION

We have been repositioning client portfolios for the inevitable global acceleration by increasing international stock allocations. We believe it is the right time to move stock allocations to a more global orientation for two main reasons.

First, as noted earlier, international markets are significantly more geared to cyclical sectors which stand to benefit most from accelerating growth and inflation. Second, relative to U.S. stocks, international stock valuations are deeply discounted, and dividend yields are significantly higher in aggregate.

The increased international stock allocation will allow portfolios to better capture the benefits of a potential multi-year global recovery and expansion while lowering overall portfolio volatility through broader (global) diversification.

RENEWABLE ENERGY AND DIGITAL COMMUNICATION INFRASTRUCTURE INVESTMENT

For many years, Capstone has incorporated an infrastructure allocation within clients’ portfolios. Infrastructure companies own and operate essential transportation, energy, and communication assets.

Infrastructure assets typically generate relatively high and consistent cash flows, supported by steady demand and long-term contracts, many of which have periodic escalators linked to inflation. As a result, infrastructure companies tend to pay out relatively higher dividends, are generally less volatile, and can provide a hedge against unexpected inflation.

The infrastructure asset class has been growing in recent years, and the COVID-19 pandemic has accelerated long-term, secular trends tied to renewable energy and digital communication infrastructure demand and investment. As such, we have changed the infrastructure strategy to better capture the benefits of these growth trends and have significantly lessened exposure to traditional fossil-fuel-related energy infrastructure.

LOW INTEREST RATE ENVIRONMENT

We have been repositioning bond allocations by increasing exposure to credit sectors (i.e., non-government bonds) and mid-grade bonds (i.e., A and BBB rated), and by expanding the opportunity set to include a limited amount of high-yield (non-investment-grade) bonds.

We have been implementing this by using institutional-quality, actively managed bond funds with experienced managers and analysts conducting thorough research on every bond issuer they invest in.

The increases to credit, mid-grade, and high-yield bonds will not come with a disproportional amount of additional risk. We continue to believe that bond allocations should be high-quality and good preservers of capital if and when stock market downturns occur.

The increased yield in bond allocations will help to enhance returns during the next few years of low-interest rates and mitigate some of the impact of unexpected future interest rate (and inflation) increases.

As always, if you have any questions, please reach out to your advisory team.

Sources

¹ Global stocks represented by the MSCI ACWI USA IMI Index has posted five consecutive quarters of gains dating back to Q1 2020.

² U.S. stock returns are represented by the Russell 3000 Index. International stock returns are represented by the MSCI ACWI Ex USA IMI. U.S. bond returns are represented by the Barclays Aggregate Bond Index. International bond returns are represented by the Barclays Global Aggregate Ex USA Hedged Index.

³ Sector breakdown includes the following aggregates: Technology (Information Technology) and Cyclicals (Consumer Discretionary, Financials, Industrials, Energy and Materials). United States Stock Market represented by the CRSP US Total Market Index. International Developed Markets represented by the FTSE Developed All Cap ex US Index. International Emerging Markets represented by the FTSE Emerging Markets All Cap China A Inclusion Index.

⁴ https://www.ourworldindata.org/covid-vaccinations

⁵ Share of the total population that have received all doses prescribed by the vaccination protocol. This data is only available for countries which report the breakdown of doses administered by first and second doses.

⁶ Personal Consumption Expenditures (PCE) Price Index is updated monthly and is the Fed's preferred measure for evaluating inflation in its assessment of monetary policy. The PCE Price Index, measures price changes in consumer goods and services exchanged in the U.S. economy and excludes food and energy.

Past performance does not guarantee future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

IMPORTANT DISCLOSURE INFORMATION

Please remember that different types of investments involve varying degrees of risk, including the loss of money invested. Past performance may not be indicative of future results. Therefore, it should not be assumed that future performance of any specific investment or investment strategy, including the investments or investment strategies recommended or undertaken by Capstone Financial Advisors, Inc. (“Capstone”) will be profitable. Definitions of any indices listed herein are available upon request. Please contact Capstone if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and services, or if you wish to impose, add, or modify any reasonable restrictions to our investment management services. This article is not a substitute for personalized advice from Capstone and nothing contained in this presentation is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. Investment decisions should always be based on the investor’s specific financial needs, objectives, goals, time horizon, and risk tolerance. This article is current only as of the date on which it was sent. The statements and opinions expressed are, however, subject to change without notice based on market and other conditions and may differ from opinions expressed by other businesses and activities of Capstone. Descriptions of Capstone’s process and strategies are based on general practice, and we may make exceptions in specific cases. A copy of our current written disclosure statement discussing our advisory services and fees is available for your review upon request.