Investing During An Election Year: What To Know

KEY POINTS

Global stock and bond markets gained significantly in 2023 amid better-than-expected economic growth, moderating inflation, and indications of ending interest rate hikes. Looking ahead, we discuss why stock market gains could continue in 2024, and why bond markets could be set for another positive year.

The U.S. economy held up much better than expected in 2023 amid significantly higher interest rates. Meanwhile, economic growth slowed and inflation pressures eased around most of the world. We provide our 2024 outlook on the global economy and inflation.

The U.S. presidential election will no doubt capture the headlines in 2024 and create uncertainty. We discuss how investors should approach investing in an election year.

Informed by current market and economic conditions coupled with a long-term investment view, we discuss our recommendations around portfolio positioning and management for the year ahead.

View a Short Summary Video

MARKET REVIEW

A BETTER-THAN-EXPECTED ECONOMY AND AN EVENTUAL DOWNWARD-SHIFTING INTEREST RATE OUTLOOK BOLSTERED STOCK MARKETS IN 2023

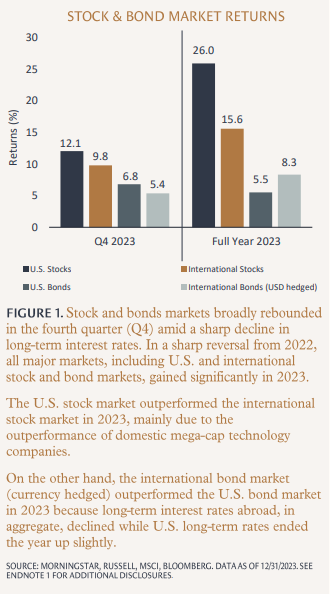

Global stock markets rallied significantly in 2023, collectively posting their best year since 2019.² The rally occurred despite earlier-in-the-year recession fears stoked by tight monetary policy, banking sector stresses, and elevated geopolitical tensions. As the year wore on, stock markets were broadly bolstered by the combination of solid economic growth amid cooling inflation, better-than-expected corporate earnings, enthusiasm about artificial intelligence (AI), and ultimately, an apparent end to interest rate hikes. (See Figure 1.)

BOND MARKETS DELIVERED POSITIVE RETURNS DESPITE CONTINUED INTEREST RATE VOLATILITY

Global bond markets finished the year soundly in positive territory, ending a streak of negative returns over the prior two calendar years.³ As mostly expected, the U.S. Federal Reserve (the Fed) gradually hiked short-term interest rates four times over the year. However, it was another volatile year for long-term interest rates amid materially shifting expectations for future monetary policy moves. The Fed spent much of the middle part of the year signaling that interest rates would stay “higher for longer” amid still robust economic growth and elevated inflation, resulting in an early-fall bond market selloff. However, the bond market recovered sharply (and long-term rates fell) during the last two months of the year as slowing job market and cooling inflation data ultimately resulted in the Fed confirming it expects to pivot to rate cuts in 2024.

MARKET OUTLOOK

STOCK MARKET GAINS ARE SET TO CONTINUE IN 2024; HOWEVER, RETURNS ARE LIKELY TO BE LOWER DUE TO HIGHER VALUATIONS AND ELEVATED VOLATILITY

Stock markets should continue to be supported over the near term as the economic backdrop has increased the likelihood that major central banks (led by the Fed) are not only done with interest rate hikes but will likely start to lower rates in 2024. Furthermore, stock market gains could continue if earnings keep coming in better than expected and if more companies and sectors (beyond the mega-cap tech stocks) start performing better. Broader stock market participation across less expensive value stocks and most mid- and small-capitalization stocks would likely occur if economic growth remains positive, inflation continues to cool, and interest rates stabilize.

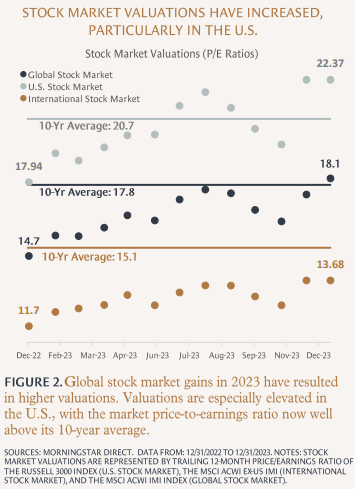

Although the current stock market outlook looks favorable, investor return expectations should be tempered. While corporate earnings grew in 2023, outsized stock price gains (particularly across the technology and communications service sectors) have increased stock market valuations in aggregate. Elevated valuations are particularly evident in the U.S. as price-to-earnings ratios (a measure of stock valuation) have moved up significantly since the end of 2022. (See Figure 2.)

Moreover, as we head further into 2024, the path for stock markets may get bumpier. Market volatility is likely to rise if economic growth slows significantly more than expected due to the lagged effects of the Fed’s tightening or if inflation flares up materially again, resulting in another Fed pivot back to a more restrictive stance. Additionally, global geopolitical risk remains elevated, and 2024 is a U.S. Presidential election year. Major U.S. elections typically result in additional short-term stock market volatility, given uncertainty about future leadership and fiscal policy.

BOND RETURNS ARE LIKELY TO BE POSITIVE IN 2024 AS EXTREME BOND MARKET VOLATILITY SUBSIDES

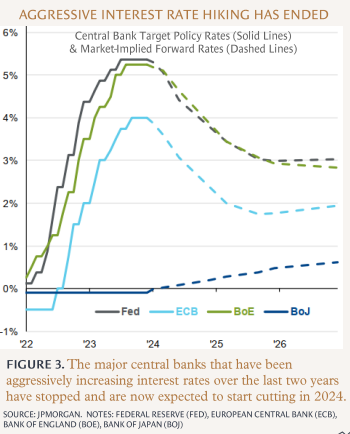

The severe bond market volatility investors experienced over the last two years has likely ended with the culmination of aggressive central bank campaigns to help reverse rising inflation and prevent overheating economies. (See Figure 3.) For now, further interest rate hikes appear off the table, removing a key source of uncertainty for bond investors. Looking ahead, the focus has shifted to whether (and when) central banks will lower interest rates, which will ultimately depend on whether a recession occurs (a "hard landing") or if inflation continues falling amid economic activity remaining positive (a "soft landing.")

If central banks start to lower rates or even indicate plans to do so sooner (or more aggressively) than anticipated, prices for intermediate and long-term bonds will appreciate, boosting their returns. On the other hand, if central banks keep policy rates at current levels for longer, investors will continue to benefit from attractive bond interest yields. Despite the recent decline in long-term interest rates, bond investors are still earning yields in the 4.5%-to-5.5% range on high-quality investment-grade bonds.⁴

ECONOMIC REVEW

THE U.S. ECONOMY REMAINED SURPRISINGLY RESILIENT IN 2023 EVEN AS INFLATION HAS DECLINED

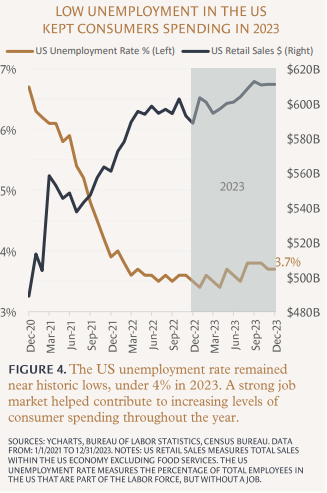

The U.S. economy held up much better than expected in 2023 amid significantly higher interest rates. Economic growth remained solid despite the first-quarter regional banking crisis, which sparked fears of a credit crunch, and political dysfunction in Washington, which raised concerns of a U.S. government debt default. Ultimately, though, the continued strength of the labor market throughout the year supported consumer spending and the economy broadly. (See Figure 4.) The U.S. economy grew 2.5% in 2023.⁶

Inflation in the U.S. remained on a downward trend throughout most of 2023. The U.S. inflation rate, as measured by the Consumer Price Index (CPI), slowed from a high of 6.4% at the start of the year to 3.4% in December.⁵ Notably, all three key categories within the CPI (i.e., goods, services, and shelter) contributed to the decline, with shelter prices most recently turning lower. The declining inflation rate caused the Fed to place interest rate hikes on hold since July, and ultimately in the year’s final months, turned their forward guidance (on future monetary policy) to be more about reducing rates.

ECONOMIC GROWTH SLOWED AND INFLATION PRESSURES EASED AROUND MOST OF THE WORLD IN 2023

In Europe, central bank interest rate hikes stalled economic growth and have weakened labor markets somewhat. Consumer confidence and spending declined throughout the European region with the ongoing Russian-Ukraine war on its doorstep compounding financial challenges. The good news however is that inflation has peaked in Europe, and a disinflation trend continued throughout the year without a significant rise in unemployment rates. As a result of cooling inflation, the European Central Bank and the Bank of England stopped raising interest rates in the fall which helped to ease financial conditions.

Economic growth in China faltered in 2023 as the housing sector continued its downturn. The property market decline negatively impacted other areas of the economy as consumers reigned in spending. Consumer confidence data highlighted this negativity. (See Figure 5.) Economic growth in China was still positive last year; however, the pace of growth was below what it had been in prior years, and it trended below the government’s 5% annual target throughout the first half of the year. As such, the government launched dozens of measures in the second half of 2023 to stimulate the economy.

In contrast to Europe and China, Japan’s economy accelerated in 2023. Consumer spending bounced back at the start of the year as the economy emerged from pandemic shadows. The country experienced strong export activity throughout the second half of the year bolstered by a weakening Yen and U.S.-China decoupling. Moreover, the long-term trend of economic stagnation and deflation in Japan appeared to have abated in 2023, and as such, the government started curtailing its long-standing policies of keeping interest rates at extremely low levels.

ECONOMIC OUTLOOK

U.S. ECONOMIC GROWTH AND INFLATION WILL LIKELY CONTINUE ABATING THIS YEAR

The U.S. economy will likely continue to slow but remain positive through most of 2024. Consumer spending should continue to grow, but more slowly as excess savings run low, job and wage gains diminish, and banks gradually continue to tighten lending standards. Business capital spending could also be more challenged as companies react to higher interest costs and slowing revenue growth. Although lower-income households and interest-rate-sensitive business sectors show signs of increased financial stress, aggregate consumer and business financial conditions are not nearly as dire as before the Global Financial Crisis in 2008. As such, if the U.S. officially enters a recession, it would likely be mild and short.

Inflation should continue easing gradually throughout 2024. Declines in shelter (rent), service, and core goods (ex-food and energy) costs should continue while supply chain bottlenecks, shortages, and other disruptions unwind further. Although inflation is still elevated (relative to the Fed’s 2% target), the Fed has likely finished this rate hiking cycle. With that said, the next leg of the cycle will probably be policy easing; however, in our view, aggressive rate cuts are not imminent given the continued strength of the U.S. economy.

ECONOMIES ABROAD ARE LIKELY TO REMAIN CHALLENGED IN THE NEAR TERM BUT GROWTH PROSPECTS SHOULD GRADUALLY IMPROVE THROUGHOUT 2024

Europe's economic growth prospects will likely remain challenged in early 2024. However, European economies will face fewer headwinds with central banks no longer raising policy rates and declining inflation. Over the year, conditions will likely improve as deflation continues, resulting in positive real (inflation-adjusted) income growth. Positive real income growth amid what should still be a relatively secure employment environment throughout Europe will likely underpin consumer confidence and spending.

In China, consumers may remain cautious for a bit longer given a weak housing market. However, policymakers are now in pro-growth mode, providing a floor to economic growth at their 5% target pace. Given modest growth relative to prior years and below average inflation, China's economy will likely remain a top concern for the country's leaders. Since government stimulus, which has already been deployed, will have more time to set in and will likely continue to be distributed, Chinese consumer sentiment should gradually improve in 2024 relative to last year's very depressed levels.

ON THE MINDS OF INVESTORS

HOW SHOULD INVESTORS APPROACH INVESTING IN AN ELECTION YEAR?

Many ongoing and looming events could impact the 2024 outlook, including significant geopolitical tensions abroad and national elections worldwide.⁷ Any of these significant events, or something else similar in magnitude, could likely add to market volatility and potentially even push affected countries into recession amid an already slow-growing global economy. Events like these have impacted markets and economies over the past several years, and 2024 should be no different, particularly with a U.S. presidential election in November.

On top of assessing the path of central banks, the stability of corporate profits, the resilience of consumer spending, and whether the economy will have a “soft” (no recession) or “hard” landing (recession), investors will have to grapple with the barrage of headlines about the election.

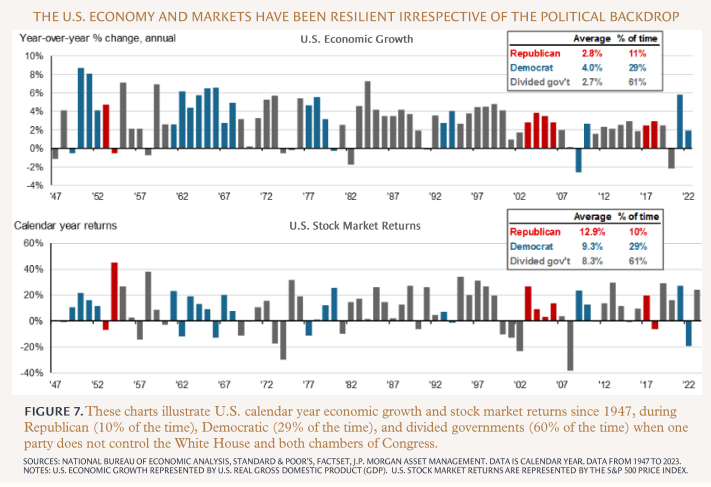

The U.S. presidential election result will be important because it will ultimately influence the near-term future of foreign geopolitical policy, global trade, immigration, and federal spending – all of which could have second-order effects (good or bad) on markets end economies. Given their potential impact, presidential elections always add an extra element of uncertainty to investing. In fact, on average, market volatility tends to be higher during election years, and returns tend to be lower because markets generally do not like uncertainty. (See Figure 6.)

Over time, however, the U.S. market and the economy have historically fared well under all government configurations. (See Figure 7.) Furthermore, we can’t conclude that the political backdrop is the only or primary driver of market performance and economic growth. Instead, it’s more likely a combination of fiscal policy, monetary policy, trade policy, labor markets, consumer spending, corporate capital expenditures, and more that drives the market and economy.

Elections create uncertainty, and their outcomes are consequential, but the ensuing impact on the markets and economy may not always be direct, immediate, or apparent. Therefore, in an election year, investors should ensure their portfolios are diversified enough to weather a short period of elevated market volatility. Furthermore, investors should position their portfolios to benefit from continued long-term market appreciation and economic growth, regardless of the political environment.

PORTFOLIO MANAGEMENT

Our recommendations around portfolio positioning and management are informed by current market and economic conditions coupled with a long-term investment view.

MAINTAIN A DEFENSIVE TILT WITHIN STOCK ALLOCATIONS

Investors should brace for a slowing economy and higher market volatility in 2024. As such, we recommend investors tilt defensively within stock allocations by overweighting to more profitable companies generating higher positive cash flows that are relatively less expensive. Profitable and cash-flow-heavy companies that don’t need to rely as much on now expensive debt financing will likely perform well over the next few years amid elevated interest rates. These companies can also better weather a potentially more challenging economic environment ahead given their stronger balance sheets.

INVEST IN HIGH-QUALITY, INTERMEDIATE-TERM BONDS

We recommend that long-term investors invest in high-quality, intermediate-term bonds, given the outlook for a more challenging economic and market environment. Issuers of high-quality bonds (i.e., investment-grade rated) are better able to weather a material economic slowdown. Moreover, intermediate-term bonds (e.g., with 4-to-7-year durations) currently pay much higher interest than they have in recent years, and they tend to appreciate in value when central banks eventually cut interest rates.

MOVE EXCESS CASH INTO BONDS

When deciding between short-term cash instruments and bonds, investors should consider the purpose of each. Generally, short-term cash instruments such as a money market fund, CD, or treasury bill are appropriate for short-term needs such as known near-term liabilities or a rainy-day fund. On the other hand, longer-term investment goals like retirement or college funding call for bonds with longer terms to maturity. Over time, investing excess cash in longer-maturity bonds is likely to increase one’s total return. (See Figure 8.)

AVOID SHORT-TERM MARKET TIMING AND REMAIN FOCUSED ON LONG-TERM GOALS

It may be tempting to change one's portfolio after a significant market run-up like the one we've experienced in 2023. Perhaps there is a desire to reduce a stock allocation for fear of a market correction, or increase a stock allocation because the market keeps going up. In our view, the action should not depend on recent market performance but instead on one's financial plan and changes to life circumstances.

Investors should review their portfolios to ensure their allocations are still appropriate for their long-term goals. We review client portfolios daily to ensure they are closely aligned with their strategic target asset allocations; if not, we rebalance them. Periodically we review portfolios with clients to ensure that the strategic allocation is still aligned with their long-term goals; if not, we make a change. We believe that a key to long-term financial success is not letting a recent bull market (or bear market) impact strategic investment decisions.

SOURCES & ENDNOTES

¹ U.S. stock returns are represented by the Russell 3000 Index Total Return USD. International stock returns are represented by the MSCI All-Country-World Ex-USA Investible Market Index (IMI) Net Return USD. U.S. bond returns are represented by the Bloomberg Aggregate Bond Index Total Return USD. International bond returns are represented by the Bloomberg Global Aggregate Ex-USA Hedged Index Total Return USD.

² Sources: Morningstar Direct, MSCI. Global stocks represented by the MSCI All-Country-World Investible Market Index (IMI) Net Total Return USD, returned 21.58% in 2023 and 26.35% in 2019.

³ Sources: Morningstar Direct, Bloomberg. Global bonds represented by the Bloomberg Global Aggregate Total Return Hedged USD, returned 7.15% in 2023, -11.22% in 2022, and -1.39% in 2021.

⁴ Sources: Bloomberg, JPMorgan. As of December 31st, 2023, the yield-to-worst for the Bloomberg U.S. Aggregate Index, a benchmark for the taxable U.S. investment grade bond market, was 4.53%. As of December 31st, 2023, the taxable-equivalent yield-to-worst for the Bloomberg Municipal Index, a benchmark for the tax-exempt U.S. investment grade bond market, was 5.44% based on a 40.8% total federal tax rate (37% plus 3.8% net investment income tax).

⁵ Source: Bureau of Labor Statistics. Headline U.S. Consumer Price Index (seasonally-adjusted), came in at 6.41% year-over-year in January and 3.35% year-over-year in December.

⁶ Source: Bureau of Economic Analysis. Advance Estimate U.S. Real GDP increased 2.5% in 2023 (from the 2022 annual level to the 2023 annual level).

⁷ National elections to be held in 2024 include Taiwan, India, Mexico, and the U.S.

⁸ Cash returns are represented by the Bloomberg US Treasury Bill 1-3M Index. Taxable Bond returns are represented by the Bloomberg Aggregate Bond Index. Municipal Bond returns are represented by the Bloomberg Municipal Bond Index. Returns average annualized total returns.

Past performance does not guarantee future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

IMPORTANT DISCLOSURE INFORMATION

Please remember that different types of investments involve varying degrees of risk, including the loss of money invested. Past performance may not be indicative of future results. Therefore, it should not be assumed that future performance of any specific investment or investment strategy, including the investments or investment strategies recommended or undertaken by Capstone Financial Advisors, Inc. (“Capstone”) will be profitable. Definitions of any indices listed herein are available upon request. Please contact Capstone if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and services, or if you wish to impose, add, or modify any reasonable restrictions to our investment management services. This article is not a substitute for personalized advice from Capstone and nothing contained in this presentation is intended to constitute legal, tax, accounting, securities, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any type. Investment decisions should always be based on the investor’s specific financial needs, objectives, goals, time horizon, and risk tolerance. This article is current only as of the date on which it was sent. The statements and opinions expressed are, however, subject to change without notice based on market and other conditions and may differ from opinions expressed by other businesses and activities of Capstone. Descriptions of Capstone’s process and strategies are based on general practice, and we may make exceptions in specific cases. A copy of our current written disclosure statement discussing our advisory services and fees is available for your review upon request.