Fixed-Rate vs. Adjustable-Rate: Which Mortgage is Right for You?

Fixed-Rate vs. Adjustable Rate Mortgage Key Points:

Deciding between a fixed-rate mortgage and an adjustable-rate mortgage (ARM) is an important decision to make when financing a home purchase.

Before choosing an ARM, it’s essential to understand how your payments may be affected by potential interest rate changes.

Factors such as how long you intend to live in the home, your current and anticipated income, and your risk tolerance towards fluctuating rates, can help you to make an informed decision on the best mortgage for your situation.

Whether it’s your first or fifth home purchase, buying a new home can be an exciting, albeit stressful time. One of the many factors to consider when financing a home purchase is the type of mortgage product to use. The question of choosing a fixed or adjustable-rate mortgage is often a long-debated one. A lower starting interest rate might lead you to favor an ARM. However, it’s important to consider several other factors when evaluating which option is the best mortgage for you. How long you intend to live in the home, your current career trajectory, your risk tolerance, and the current interest rate environment are all significant factors to evaluate in order to make an informed decision.

Understanding how an ARM works

The primary risk in selecting an ARM is the potential payment increase due to an interest rate adjustment. An ARM has an initial fixed interest rate for a period of time (typically 3, 5, 7, or 10 years) and then adjusts over the remaining term of the loan. Adjustments are typically made annually; this is typically represented by the “1” in a “5/1 ARM”. (A more recent trend is for adjustments to be made semi-annually.) Regardless, the rate adjustment is typically based on the Secured Overnight Financing Rate (SOFR) plus the lender’s margin rate.

An ARM is usually restricted by rate caps, which limit the increase in the rate for an individual loan. For example, a 5/1 ARM could be expressed as having a “5/2/5” cap structure. This means that after the initial fixed term, the rate can adjust a maximum of 5 percentage points at the first interest rate change date. Thereafter, the rate can adjust a maximum of 2 percentage points at each subsequent change date. Then, over the lifetime of the loan, the rate can never adjust higher than 5 percentage points over the initial rate. (See Figure 1.)

Beginning with the 61st month in the following illustration, the monthly payment could increase by $1,278.74. The affordability of the potential payment increase may be reason enough go with a fixed-rate mortgage instead. If you find yourself unable to afford the new payments, you may have the option of refinancing, but this comes with closing costs and the new market rates. In addition, if you choose another 30-year term, you are extending your loan out further, adding on additional interest.

When Choosing an ARM Makes Sense

So when does it make sense to select an ARM? One of the most compelling reasons to pick an ARM is that the initial interest rate is typically lower than a traditional 30-yr fixed-rate mortgage. This initial lower rate will not only allow you to save interest and increase your cash flow; it can also increase your buying power significantly, depending on the size of the mortgage. An ARM may also make the most sense if you: earn large commissions or bonuses that can accelerate your loan payments, intend to move before the initial fixed term is up, or have a career trajectory that will allow you to afford larger payments in the future.

When to Choose a FIXED-RATE Mortgage

An ARM may not make sense for everyone. So, when does picking a fixed-rate mortgage make the most sense? A fixed-rate mortgage may work well if you don’t expect your income to change much over the years, or plan to be in the home past the initial fixed-term of an ARM. It may also work well if you simply do not want to worry about the possibility of an annual interest rate increase. (See Figure 2.)

Can You Assess the Current Interest Rate Environment To Predict Future Trends?

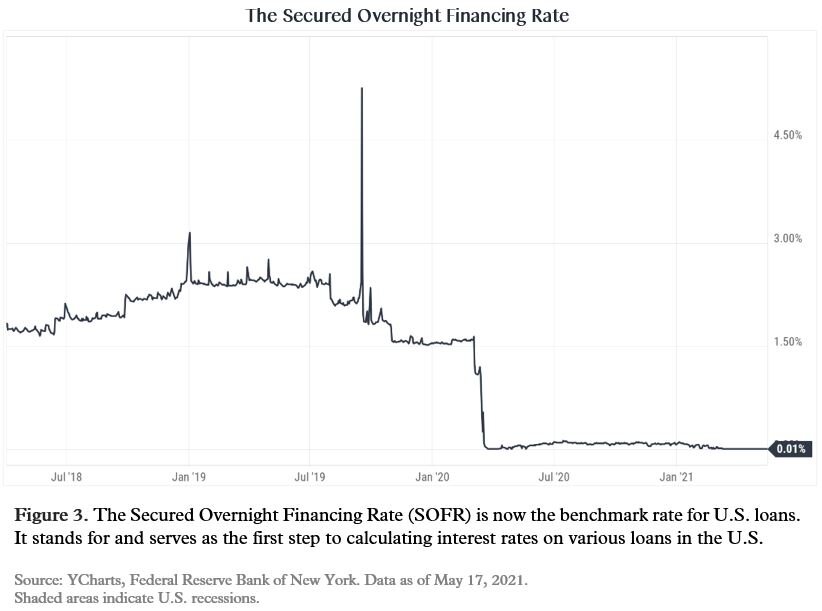

Recognizing where the current interest rate environment is trending can be another important factor in deciding between a fixed or adjustable-rate mortgage. However, there is no way to accurately predict the future direction of interest rates. The SOFR is now the most widely used global benchmark for short-term interest rates—it is used by mortgage lenders to determine and adjust their ARM rates. (See Figure 3.)

Historically, when the economy is in or about to head into a recession, short-term interest rates like SOFR tend to decline. Conversely, when the economy moves out of recession periods and into periods of expansion, short-term rates tend to either stop declining or steadily increase. There is no way to predict when exactly a recession will occur or how long a recession will last. The interest rate environment is unpredictable.

Conclusion

Deciding between a fixed or adjustable-rate mortgage is not always easy; however, it is an important decision to make when financing a home purchase. We encourage you to evaluate factors such as how long you intend to live in the home, your current income, and your risk tolerance towards fluctuating interest rates, to make an informed decision on the best mortgage for your situation.

Capstone Financial Advisors know that managing, growing, and protecting your wealth shouldn’t be complicated. Contact us below to answer any questions you have. Let us help you today.